EM by EM #3 – Copper comeback?

In my latest article, I discussed the specifics of the economic cycle in China and presented our preferred strategy. Unfortunately, we have faced some challenges with our positions and I now realize that we missed an opportunity by not trading the spread between the CSI and the consumer-weighted ETFs, which we initially favored.

Nevertheless, we maintain our belief that our fundamental thesis remains valid and expect that China’s export industry will face challenges due to weakened export demand in the upcoming quarters. Recently, we have noticed price fluctuations due to geopolitical sentiments and investor risk aversion, which we believe are somewhat exaggerated but still worth considering. As a result, we have hedged our positions against the CSI 300.

We do not maintain a bullish stance on commodities or industrial metals as a whole – primarily due to our outlook of a slowing global economy. Nevertheless, we have pinpointed particular segments within the commodity market that we think require closer attention and continuous monitoring. One such area of interest is the copper market which we thought we would offer our latest thoughts on.

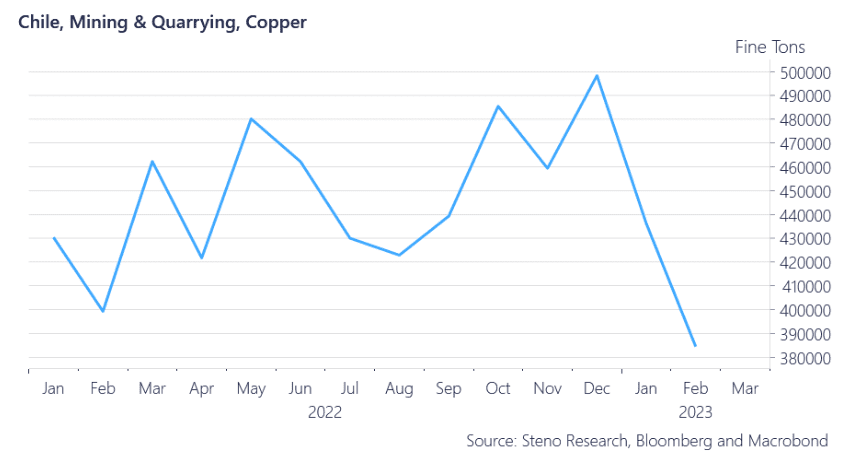

Why, you might ask, given the expectation of weakening demand? Well, demand is just one side of price equilibria and production has collapsed in q1 one:

Chart 1: Copper production collapse in Chile in Q1

In Q1, we had a long position in copper. However, since our exit, industrial metals have experienced a reversal, and most of the gains YTD have been wiped out. But could the copper story have another leg to it? In this piece, we will share our perspective combining the macro with the development from the relevant EM frontlines.

0 Comments