The Energy Cable #20 – The Tension Builds

Welcome to your maverick energy newsletter from both sides of the pond. There has been a growing discrepancy between the models of 3Fourteen Research and Steno Research in recent weeks, which is what makes a market. The Chinese reopening is the key to a persistent upwards pressure in oil space and we are both yet to be convinced that Chinese energy intensive sectors rebound.

Find our updated price models below!

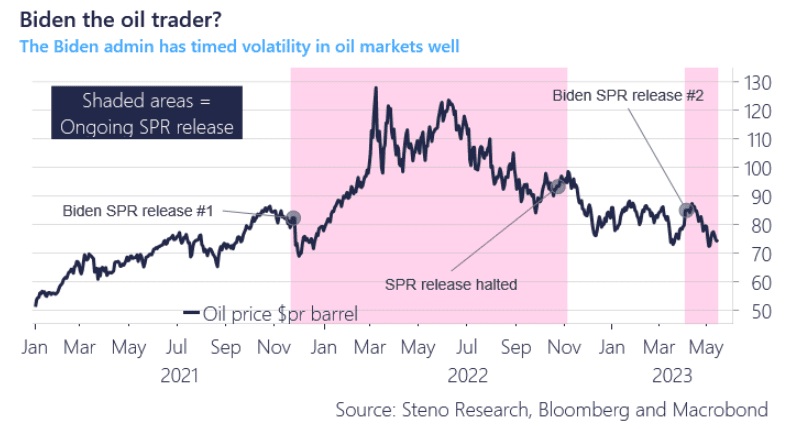

Steno Research: The trade of the year award goes to Joe Biden

Joe Biden has been one of the best oil traders during 2022 and 2023. Outside of the initial (violent) spike during the early phases of the war in Ukraine, Biden and his ilk have managed to sell oil expensively.

The most recent reintroduction of SPR releases was also timed perfectly to match the OPEC+ supply cut and it hence allowed the administration to sell into the spike in prices. The question is whether you dare to bet AGAINST the flow of the Biden administration? Price action has turned bearish since the second round of SPR releases commenced and at the current pace they will have plenty of ammunition to allow the release to run its course for many quarters.

The Chinese comeback is still very services based, which has proven to be an issue for the energy bull case. Will the Chinese momentum be reignited in H2 and where does it leave the energy space?

0 Comments