The Energy Cable #18 – Dwindling USD liquidity and Oil

Steno Research: Liquidity is drying up. How will commodities react?

The debt ceiling soap opera and the deferred consequences for interest rates and liquidity is on everyone’s lips, and it could very well pose significant ramifications for financial markets – hereunder energy – and especially those most sensitive to liquidity fluctuations.

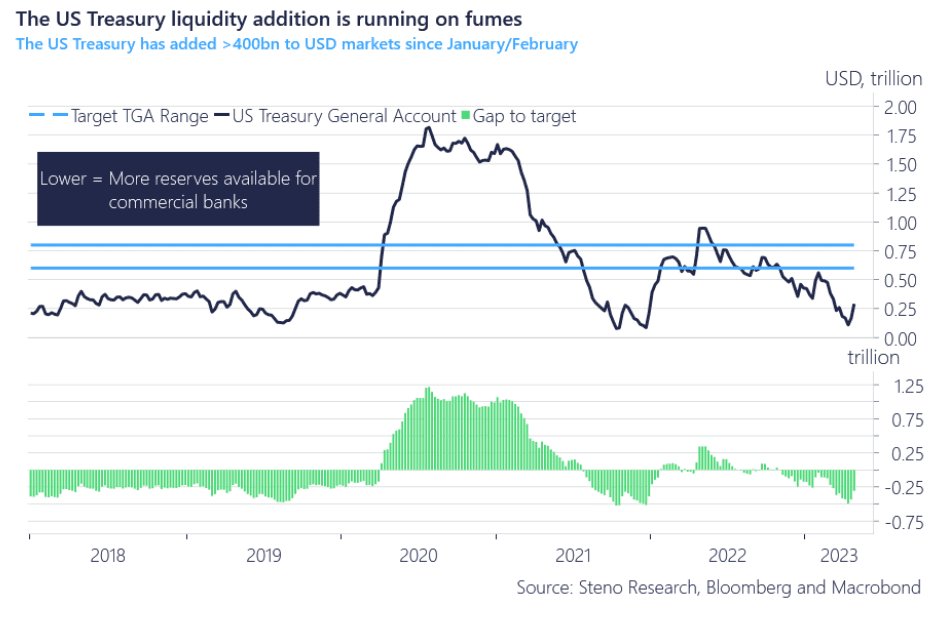

At the time of writing, the Treasury General Account (TGA) is at levels just above $250bn, though the medium-term target is probably between $600-800bn. Due to the one-sided forecasting errors on the solidity of the budget, we do not find much confidence in these, but rather see lucid risk of an advanced true x-over date for the US Treasury.

The bottom-line is that banks and fiscal authorities are slowly but surely getting on the same page regarding the question of interest rates, which will prove to be an effective lobby against further interest rate hikes into the second half of the year. With such key stakeholders aboard the pivot-train, we find the likelihood of a policy rate U-turn from the Federal Reserve growing, despite the lack of a true crisis to truly justify such a pivot.

Nevertheless, as the TGA is being bolstered, liquidity is drying up by the day. Such liquidity withdrawal is, with very few exceptions, negative for assets – energy included. When the debt ceiling deal is signed (already in May?) the liquidity withdrawal will continue at full speed.

Few markets have shown ambiguity like energy markets have, and the ghost of 2022 still haunts many investors deterring them pulling the trigger. Is a sequel brewing, or will the deterioration continue? We present to you two different takes on the matter.

0 Comments