Positioning Watch – Where to find value currently

Hello everyone, and welcome back to our weekly positioning overview. We’ve been working on some new ways to look at positioning data across asset classes, and we’ll share some of the inaugural charts in today’s piece and will extend them, week by week.

Markets have more or less traded sideways since the start of the year, as the risk-on party has taken a bit of a breather it seems, despite rate cut expectations becoming even more embedded after the hawkish US CPI surprise last Thursday – strange move, and we’ll be surprised if probabilities don’t reverse within the next couple of price data points.

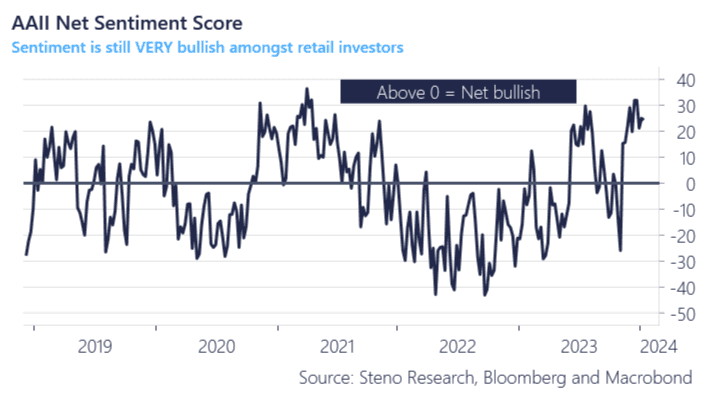

Equity sentiment is still bullish overall, but price action is starting to hint at some degree of caution within asset allocation. Retail investors are still extremely bullish (around levels last seen in 2021), and the liquidity addition that we have been rambling about for weeks now seems to kick in, with monthly inflows in the big US indices now starting to turn again, and Nasdaq inflows have turned positive after being negative in the most of December where SPY inflows spiked.

Chart 1: Retail sentiment remains high

The risk aversion theme for 2024 continues as data is starting to go against consensus, and the question for 2024 will be where to find true value in asset markets. A couple of thoughts and charts on that here.

0 Comments