Positioning Watch: The mystery behind the massive shorts in equities and bonds

Happy Saturday, and welcome back to our weekly positioning watch, where we take you through all asset classes and share the positioning of traders based on the weekly CFTC report as well as giving you some insights about how we position in response. We always aim to provide you with timely updates on what we do with our money, and we are so excited to finally launch our model portfolio on Monday, where you can follow our portfolio, returns and more in real time. Stay tuned!

Equity markets are rallying on the back of debt ceiling optimism and bullish price action within the tech space, while the EUR optimism has started to turn. Meanwhile, some of the most defensive positions in FX (CHF and USD for example) have performed while precious metals have sold off recently, so apparently markets can’t make up their mind on if we will get a recession or not.

On the other side of the spectrum, bond traders are betting on inflation to reaccelerate and have increased their shorts in the short end of the yield curve. When will we start to see the effects on bonds from a slowdown in the economy?

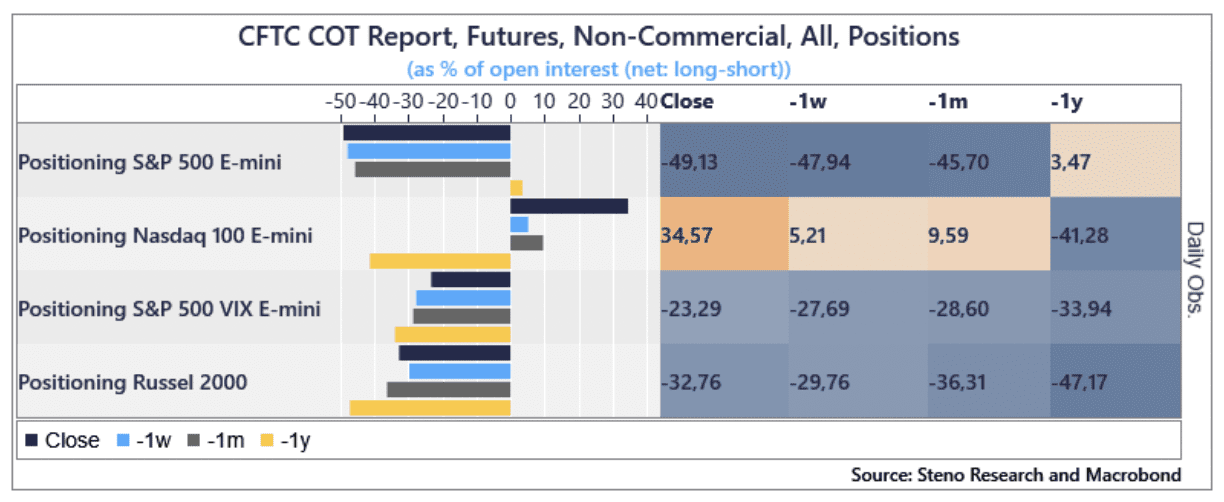

Equity Positioning

- Nasdaq positioning is turning fairly bullish, which drives the overall performance of US equities. Time to take some profit on the interest-rate sensitive index?

- Rest of the indices remain bearish from a positioning perspective, but there might be a twist to it

- Data is biased by basis trading performed by market makers and institutions who shorts the future as a hedge against their own (or clients net flow) long spot portfolio

- DAX at an all time high? Seems crowded to us.

But is the equity short as heavy as depicted in the CFTC data? Find out how we assess the data with a 14-day trial below.

Chart 1: Equity positioning

Based on price action, equity optimism is back, but positioning data tells us another story. We unfold the mystery, as well as providing you with positioning data across asset classes. Find out if you share the view of traders in this week’s edition.

0 Comments