Positioning Watch – The cocktail of heavy logs in both equities and bonds

Hello everyone, and welcome back to our weekly positioning watch, which due to delays in the CFTC data has been postponed to today (data was available yesterday evening).

After a dovish surprise today in the US CPI print we turn our eyes toward the current positioning. Equity markets may continue their run upward if we are right in our prediction from here and yields have had a party today. But are markets ready for yet another leg-up on the November bear rally merry-go-round?

Read along, as we run through each asset class, asset by asset.

Equities

- While CFTC data mostly show a net short in most US indices (mostly due to basis trading as we’ve covered before), the actual trends are very bullish from a flow perspective. Volume is although not as heavy as previously this year, which could be a sign that investors and traders have turned more cautious.

- Nasdaq net fund flows (QQQ minus short QQQ) have turned negative while SPY, Russell 2000 and DJI are all positive. This could indicate that people are banking some profits on long tech ahead of year-end.

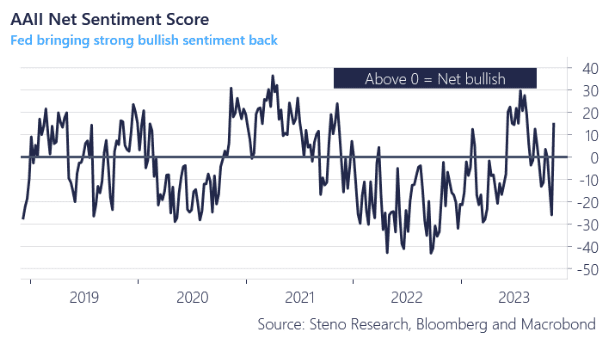

- The AAII Net Sentiment score is back in positive territory, and it thus seems like everyone favors trading equities from the long side instead of the short side at these levels. We’re not necessarily sure we agree.

Chart 1: AAII Net Sentiment score

After today’s soft inflation report from the US, we have a look at how markets are positioned at current junctures. Find out if you have your eggs in the right basket, and what consensus is currently.

0 Comments