Positioning Watch – The Chinese disappointment is written all over the latest positioning

Hope you’re enjoying the weekend out there! Weekends provide the perfect opportunity to review the market’s performance over the past week – and this week has again been full of volatility with the CPI report released this Thursday along with bonds remaining indecisive about the future market direction.

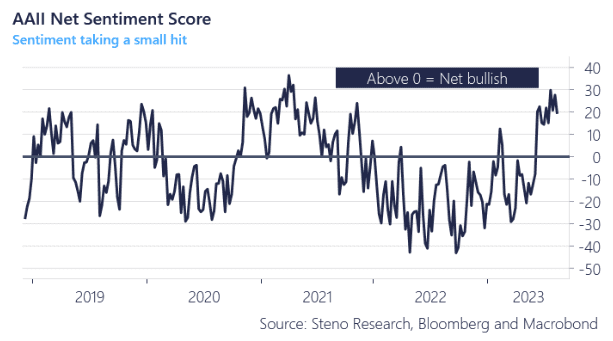

The overall sentiment this week again has optimism written all over it with equity sentiment still hovering at 2021 highs on some of the short-term indicators, and GBP and EUR are continuing their positioning resilience, while commodity markets are starting to signal weaker demand again after a couple of weeks of strength.

Follow along as we dissect market sentiment and positioning data below.

Equity Positioning

- Overall equity positioning is still going strong after the recent earnings season with multiple companies reporting strong earnings and sales despite darker clouds hovering over markets, which have been shown in the past 2 weeks with multiple days of bearish price action in the bigger indices.

- S&P 500 positioning is maybe starting to turn for asset managers, and we might run into a period where the bigger players are not putting on as much equity risk as previously

- The move from growth to value looks to have started, and it will be interesting to see how this moves market positioning

Chart 1: Sentiment cooling off, but still around 21’ highs

CPI is cooling with economic data still suggesting that we are in a Goldilocks scenario. But are markets claiming their victory too early? And will unusual optimism be the catalyst for a recession?

0 Comments