Positioning Watch: Prepared for a Short Squeeze?

Hello everybody and welcome back to our Monday Positioning Watch!

We’re here again on this fine Monday, ready to delve into our take on the market’s current temperature based on the latest Positioning and CFTC data.

Last week (see here), we left off with the possibility of an impending bear market rally. If that indeed plays out, it’s the positions with the heaviest shorts that are most at risk and we expect the bleeding is not done

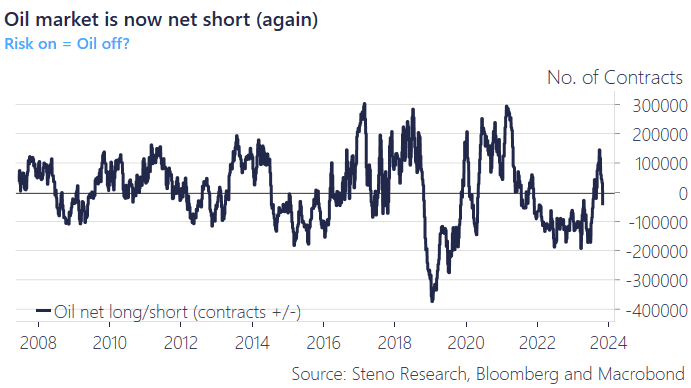

On the flip side, the market has shifted its negativity to the least interest-rate sensitive and cyclical asset: Oil.

Commodities: Short and Safe

Chart of the week:

Chart 1: Oil net short

Last week’s rally was truly remarkable, especially considering the months of hardship that most assets endured prior. Could this be the long-awaited revenge of the longs, with short covering poised to dominate the price action in the days ahead? Dive into our analysis below to find out.

0 Comments