Portfolio Watch: November Bear Market Rally?

Hello Everybody and welcome back for our weekly Portfolio Watch!

As I am sure you are aware, we have been awaiting the exact market move we have seen this week: The long end of the UST curve catching a breather fueling an inevitable risk-on rally.

That fear is essentially why we have abstained from going full-on short beta these past weeks. A decision we are content with this week.

Alas, we recently came to the conclusion that the risks of a bond relief clearly outweighed the reward left in being long risk assets. But here we are with equity shorts under the water but luckily helped by the performance of our bond-long position.

We maintain our stance on this matter, even though this week marked the first risk-on rally in a while and a short squeeze may continue into next week, but we remain convinced that bonds and equities will not continue to exhibit a strong correlation.

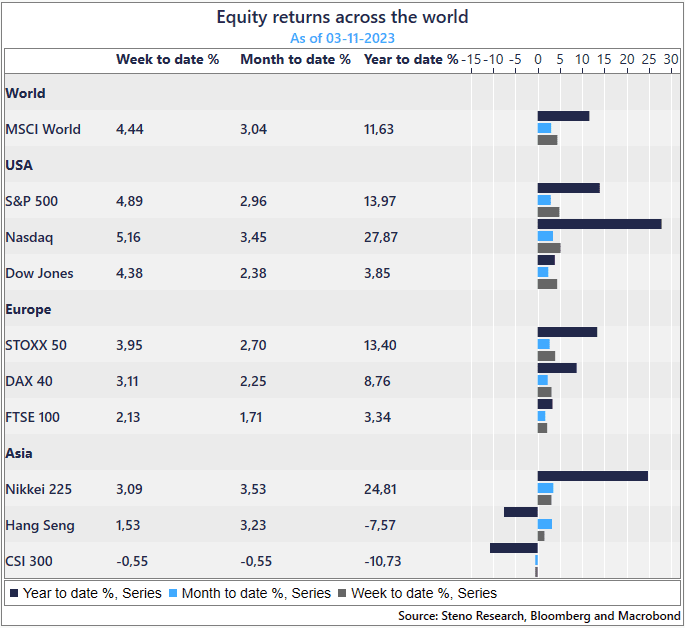

Nevertheless, the recent rally has been noteworthy

Chart 1: Equity Performance

A mixed week for us with duration performing, but our equity spreads have taken a beating along with our 1 naked short. We booked some profits and added further exposure in Fixed income. Read below for our full take on the week and how we see the market in coming weeks

0 Comments