Positioning Watch – How are markets positioned in inflation?

Like we mentioned in the first positioning watch of the year, holders of risk-assets have entered a slightly more cautious stance, and the classic risk aversion dynamics seem to be back as inflation expectations have been on the rise yet again since December. The Fed now find themselves at an interesting crossroads as the inflation battle may turn out more difficult than anticipated, but the gifts have already been handed out, and markets are again pricing the Fed to be the most dovish central bank in 2024 (mispricing of central banks are apparently a market speciality).

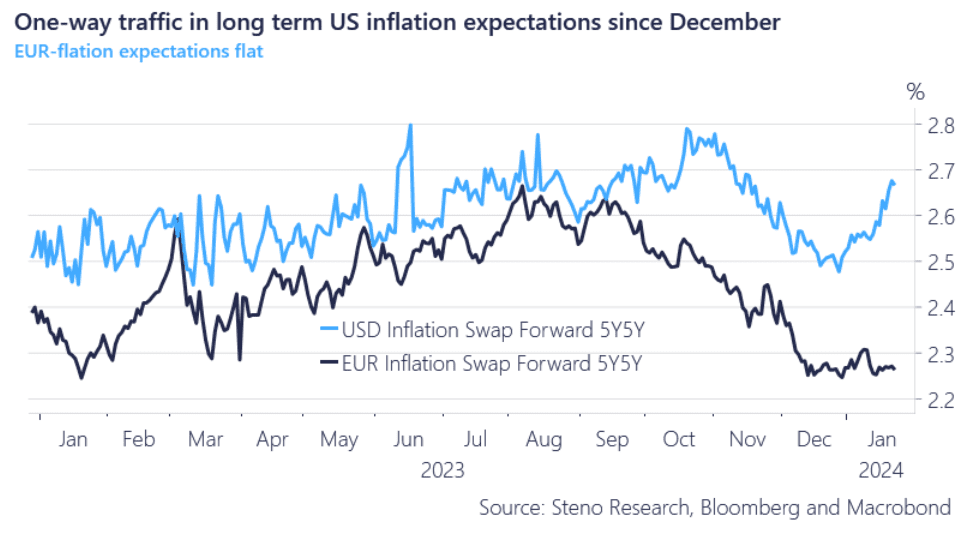

The chart below is also a clear proof of the market’s inability to be forward-looking. Troubles in the Red Sea and higher freight rates have nothing to do with inflation in 5 years (besides a small premium that captures the probability that the price effects are here to stay), and none-the-less markets are still factoring it in long-term inflation swaps it seems.

Chart of the week: Diverging trends in inflation expectations

The path to 2% has proven to be more difficult than anticipated, and the disinflation-trend is now potentially starting to turn in the US. Are markets positioned accordingly?

0 Comments