Portfolio Watch: Staying afloat in a Storm of Uncertainty

Hello everyone, and welcome back to our weekly Portfolio Watch, where we dive into the latest market trends and candidly assess our portfolio

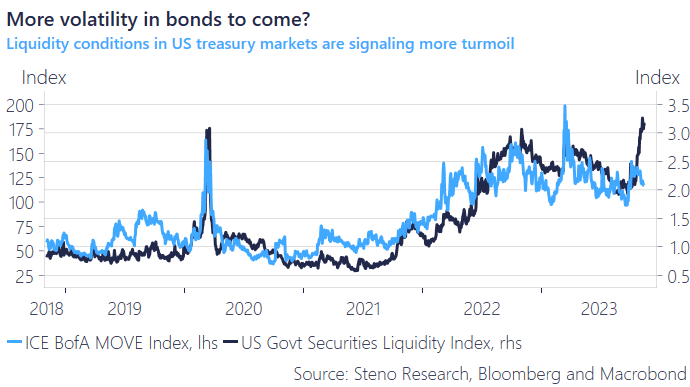

All the talk in town is the US Treasury market and it seems no matter where you place your chips you are effectively trading the momentum of US bonds, if not directly then by proxy.

As a token of the current uncertainty within the safest and most liquid fixed-income market in the world, yesterday’s howler of a 30-year treasury auction stands out as an example of just how on-edge nerves are in the financial markets these days.

If the 30y auction was a reality check on the duration appetite we can only imagine the actual consequences of a standard QRA issuance plan and not the heavy bill-tilted one that Secretary Yellen ended up presenting.

Whether the well-timed issues at ICBC are to blame for the fiasco of an auction yesterday remains unclear but we find little evidence that there is a massive duration appetite out there despite the 30y having largely rebounded from the auction low.

In any event, the mere uncertainty hereof only serves to add to the already volatile state of the market.

Chart 1: MOVE vs US liquidity index

Market seems to be all over the place these past trading days and November has thus far both been trick & treat. We are green and have entered new positions. Read our full take below

0 Comments