Portfolio Watch: Peak Dovishness & more liquidity?

Hello everybody and welcome back to our weekly Portfolio Watch!

The speed at which financial market narratives shift nowadays never ceases to amaze us. Last quarter saw a notable drop in inflation expectations, but now, we’re observing supply chain disruptions and escalating geopolitical risks pushing oil prices higher, potentially reversing that entire trend.

The effect of these recent developments on the market and their continued impact on the economy is still unclear. Similarly, the evolving situation in the Middle East, which is driving the supply-side narrative of increasing costs that has caused the recent spike in volatility

But we can speculate here ex-ante: In the end, the economy’s ability to adjust to and absorb these rising costs will largely depend on the behavior of demand

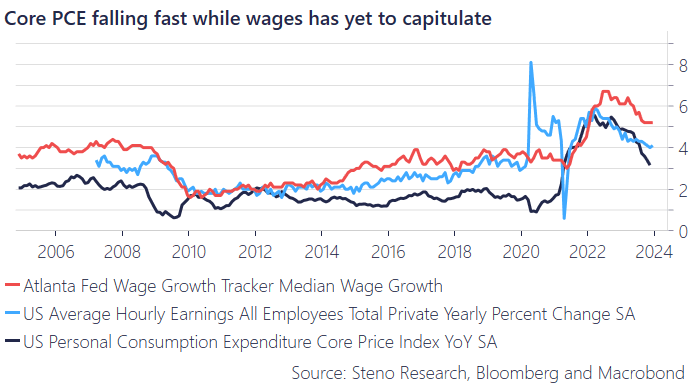

Chart 1: Core PCE vs Hourly Earnings & Atlanta Fed Growth Tracker

While we’ve persistently underscored the risks of intensifying conflicts in the Middle East and enduring inflation in the US, it’s evident that politics serves as the unifying factor behind both. Read how we are playing this environment below!

0 Comments