Out of the Box #24 : Too little too late Powell?

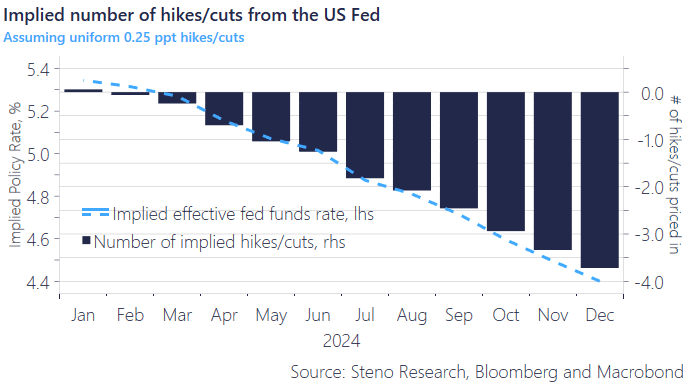

Here at Steno Research, we have been rather vocal about how we find that the odds of a hike are perhaps a bit higher than what the market is willing to accept at this point.

That call of course heavily relies on data releases in the lead-up to the December meeting and given that we are approaching the last innings of the cycle, we won’t at all dismiss the idea that temporary data could be subject to revision and/or prove unusually divergent from the underlying reality in such a way, that our conviction may be misguided- the very low implied hike-probability combined with materially lower FCI and our models hinting at above-consensus readings in store nevertheless makes it tough not to take a contrarian side in the immediate lead-up for the next FOMC decision.

Chart 1: Implied Fed Policy

A “hump” may be on the way in the US economy but can the Fed steer clear of the gathering storm, while Chairman Powell has left the market in front of the monetary policy wheel? We remain skeptical

0 Comments