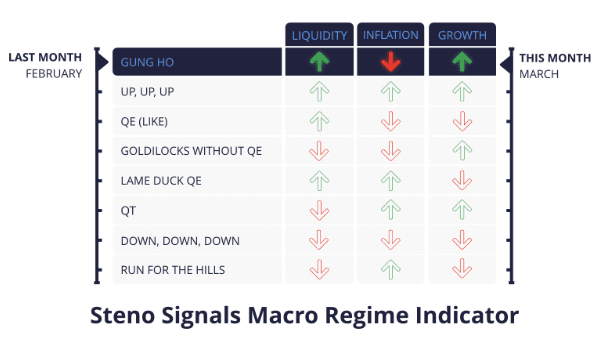

Macro Regime Indicator: MORE liquidity is coming

Greetings and welcome to this month’s Macro Regime Indicator. Financial markets have behaved pretty much just as we laid out in last month’s predictions. Sentiment remains strong and the US consumer continues to spend. Fueling growth, certainly, but we are not convinced that it has decoupled from inflation (despite productivity and all), and we see increasing risks to inflation bottoming above target. Hikes then? Unlikely, but markets may be underestimating the LONGER, confusing it with ‘higher’.

In this publication for February, we concluded the following, which turned out to be pretty accurate and still not all that different to what we see for the coming month:

“As we venture into February, optimism prevails with various indicators flashing green for the US economy. … However, this robust uptick warrants a set of concerns, particularly regarding inflation. A base case 0.1% MoM print for January translates into a tempered 2.9% YoY, but the robustness of economic growth across most gauges, not least with easing FCIs and bottoming wage growth, could invoke subsequent inflationary pressures. Liquidity, while we see a rise of 2.3% MoM, is not as supportive as January’s surge, but it should nevertheless tailwind risk assets further.”

Trades we like currently:

- Most…

We see little change to the optimistic and risk-favoring sentiment for March, and we thus remain in the goldilocks ‘Gung Ho’ regime. With tailwinds from both liquidity and growth, we continue to see a great case for continuing to move/stay further out of the risk curve when it comes to allocation. Especially as risk assets are not as sensitive to accelerating inflation as long as central banks remain stuck with an easing/”peak rates” bias, which we have continuously flagged and see increasing likelihood for.

Chart of the month: Macro regime remains bullish and procyclical for March

Our ISM model still points to a strong rebound in manufacturing PMIs > 50 not least due to better looking order books and easier financial conditions. For inflation, we expect February numbers to come in around the last print at 3.1% YoY which translates to a 0.4% MoM print. For liquidity, it looks like the historical correlation between issuance and ON RRP is back into play, which provides for a benign liquidity picture ahead, with our models pointing to a 2.6% increase in March.

Just as we identified in last month’s regime – and as our asset allocation model predicted -, risk assets have indeed performed. Question is if they will continue to. As always, we present our model framework on how to structure your portfolio.

0 Comments