Macro Regime Indicator: Time to embrace a new economic dawn?

The recent performance of the US economy prompts a reassessment of long-held market sentiments. As we witness an intersection of sturdy growth, moderating inflation, and evolving liquidity dynamics, investors and policymakers alike stand at a crossroads.

This month’s ‘Macro Regime Indicator’ questions the endurance of the current (US) economic strength and its implications for inflation and asset allocation. Ultimately, we consider whether it’s time to discard the cautionary (and so far costly) tales of bears and embrace the potential of a new economic dawn with productivity allowing for abating inflation AND convincing growth. Join us in unraveling the complexities and the strategic opportunities it presents.

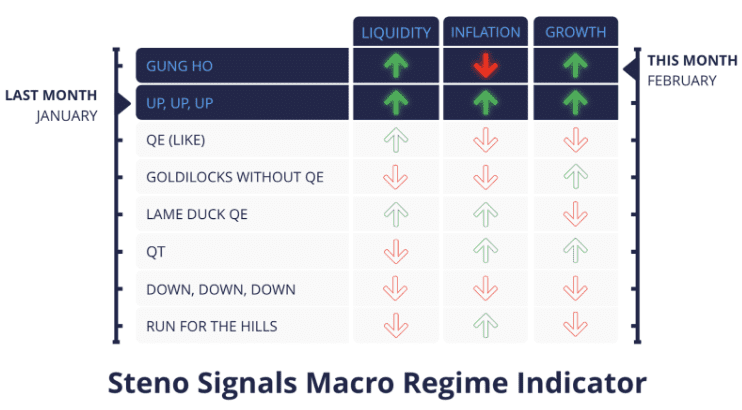

In this publication for January, we concluded the following, which proved to be spot on. Our Macro Regime Model turned upbeat in October and has remained upbeat since, which has been a timely and healthy flip towards increasing optimism around risk asset performance.

“For January, rising liquidity will be the overarching driver of short-term movements in asset prices as increased issuance in January moves money from the ON RRP into government accounts used for spending. Our models are hinting at a 3.7% increase in January alone! For inflation, we expect a modest increase in headline prices in line with market expectations with conflicts in the Red Sea likely to spill over to US CPI. For growth, our models suggest a slight uptick in growth over the course of January with lagged effects of USD weakness looking to provide tailwinds for the manufacturing sector. To sum it up, we land in the ‘Up, Up, Up’ regime”

As we venture into February, optimism prevails with various indicators flashing green for the US economy. Growth is not merely inching forward but appears to be taking confident strides as reflected by ISM PMI, which we expect to flip >50. However, this robust uptick warrants a set of concerns, particularly regarding inflation. A base case 0.1% MoM print for January translates into a tempered 2.9% YoY, but the robustness of economic growth across most gauges, not least with easing FCIs and bottoming wage growth, could invoke subsequent inflationary pressures (just ask timid Powell). Liquidity, while we see a rise of 2.3% MoM, is not as supportive as January’s surge, but it should nevertheless tailwind risk assets further.

We see growth UP, inflation DOWN, and Liquidity UP – The goldilocks ‘Gung Ho’ regime.

This month’s macro regime – Gung Ho!

With beyond robust US economic growth, the interplay of growth, inflation, and liquidity takes center stage. How will this persuasive expansion shape the inflation trajectory and inform structural asset allocation strategies?

0 Comments