Macro Regime Indicator: Heavy long in cyclical FX

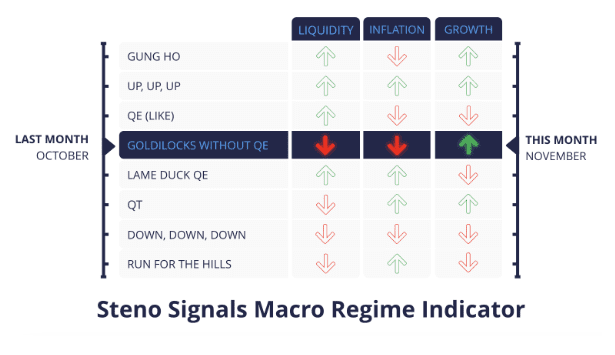

With the turn of October, it’s time for our monthly evaluation of both the present and coming month’s macroeconomic conditions, in which we weigh risks against rewards. In order to do so, we employ both our Macro Regime Indicator framework and the interactive Structural Asset Allocation Model. In combination, these tools provide an empirically rooted portfolio allocation, given the identified macro conditions and drivers in financial markets. The model scans all asset classes for the best risk/reward in sharpe ratio terms given the underlying macro assumptions inputted.

Let’s have a look at the details!

Coming into October, we wrote that:

“For October, we expect cyclical growth to continue its upward trajectory with manufacturing outperforming services. Inflation is a tricky one from here as energy has soared broadly … Conversely, ISM prices paid came in lower than expected. Liquidity will continue to dwindle from still diminishing credit availability, balance sheet tapering, and scheduled treasury issuance.”

Our allocation model suggested longs in Silver, Gold, USDJPY and USDMXN among other things through October, which yielded strong results.

For November, we expect improvement in the US manufacturing cycle. Despite the latest ISM PMI of 46.7 vs. est. 49, our models still suggest PMI’s above consensus, and if the latest Chinese stimulus works as intended, it will only boost global activity further very short-term. With regards to inflation, the Euro area is firmly approaching 2%, and judging by PPIs, ISM prices paid, and wage growth, so is US inflation – albeit with a much more cumbersome trajectory with room for upside surprises. The quarterly refunding report from the US Treasury was far from the issuance-bazooka that some had expected, but paired with QT and tight credit availability, liquidity ought to dwindle further.

In conclusion, we expect modest momentum in growth, inflation slightly down, and still receding liquidity; A regime we’ve labeled ‘Goldilocks without QE’.

This month’s Steno Research Macro Regime: Goldilocks without QE

Just as most tabloid models forecasted a near-0% chance of a recession within the next year, markets reacted in stark contrast. Can the recent broad based selloff and the following and current rally be explained by developments in liquidity, inflation, or growth?

0 Comments