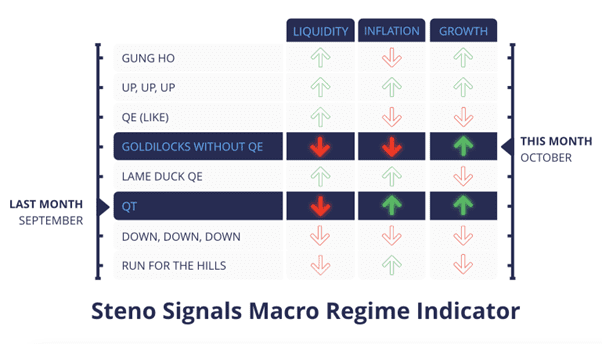

Macro Regime Model: Inflation down while growth is on the up?

Every month, we present our best evaluation of the present and approaching month’s macroeconomic conditions, balancing risks and rewards. We put to use our Macro Regime Indicator framework, alongside the interactive Structural Asset Allocation Model, to carry out this analysis.

Coming into September, we wrote that:

“Looking ahead, we do not expect sudden shocks or changes to the current conditions. We remain firm in our views around manufacturing taking center stage while services weaken, as well as an increased risk of a marginal increase in inflation according to some measures. No need to sound the alarm bells around liquidity yet.”

For October, we expect cyclical growth to continue its upward trajectory with manufacturing outperforming services. Inflation is a tricky one from here as energy has soared broadly, and in the past two days we’ve had employment clearly exceeding expectations – both in the JOLTS and ISM reports. Conversely, ISM prices paid came in lower than expected, and prices paid at the pump receded. Liquidity will continue to dwindle from still diminishing credit availability, balance sheet tapering, and scheduled treasury issuance.

In conclusion, we see growth up, inflation slightly down and, though markets don’t tend to care, liquidity down; A regime we’ve labeled ‘Goldilocks without QE’.

This month’s Steno Research Macro Regime: Goldilocks without QE

Markets have acted out of sync with fundamentals for a while, but can the latest weakness across most markets be explained by developments in either liquidity, inflation, or growth?

0 Comments