Macro Nugget: The Eurozone horserace

Since the summer, I have maintained a bearish outlook on the Eurozone. I’ve previously highlighted how the unique political dynamics within the region could potentially lead to market distrust and subsequent credit stress. It appears that this scenario is gradually unfolding.

Meloni is actively selling state assets, Scholz is facing challenges on multiple fronts, and Poland’s upcoming election could add to the growing concerns in the halls of Brussels. In summary, the Eurozone’s underlying fragility is becoming more evident, and markets are beginning to take notice, as reflected in BTPBUND spread hovering around the 200bps mark.

What’s particularly noteworthy is that this fragmentation of the political landscape is occurring concurrently with an economic downturn- or an outright recession in several Eurozone countries, including Germany and the Netherlands. Outside the Eurozone, both Sweden and the UK are also facing economic peril.

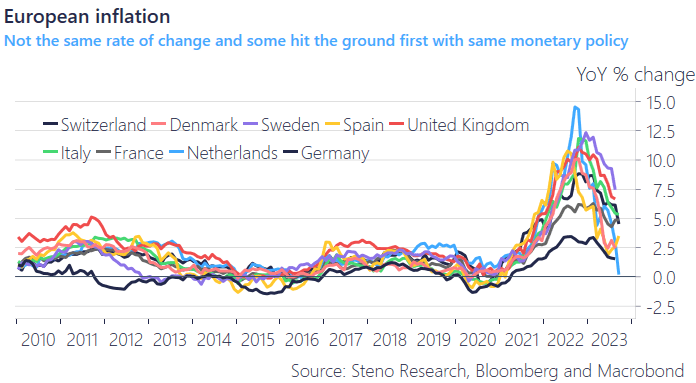

The Eurozone is a currency union of horses where each member may be running in the same direction (roughly at least), but the speed is certainly not the same across states: Netherlands is on the brink of deflation while Italy’s inflation is running around 5%.

How the table’s have turned:

Chart 1: European inflation

The Eurozone bear case seems to finally be playing out but what is the current state in Europe? Bleak and divided are two words that spring to mind.

0 Comments