Energy Watch: Is Nat Gas THE macro case of 2024?

We have been banging the drum on a cyclical rotation due to improving Manufacturing dynamics, and the PMIs released today mostly underpinned our view.

French and US Manufacturing PMIs surprised on the topside, while German Manufacturing remained stuck in the abyss, but the anecdotal evidence supported the rise in the orders book relative to inventories that we have noted lately.

From the US PMI release:

“Goods producers signaled the steepest rise in new orders since May 2022, as customer demand improved for a second month running”

From the French PMI release:

“That said, there were reports of demand conditions improving, with production at some manufacturers being boosted by restocking efforts”

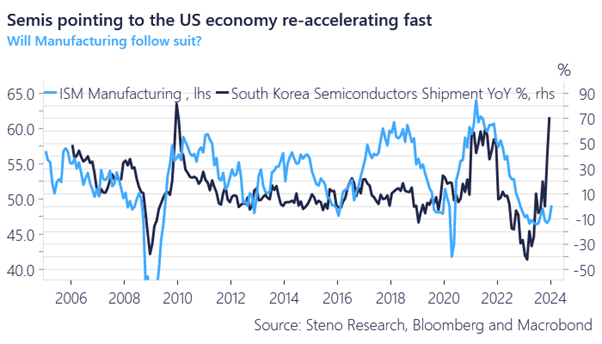

Both conventional (orders to inventories) and unconventional leading indicators (Semi Exports) rhyme with an improving Manufacturing cycle short-term. How is the commodity priced relative to such a potential upswing in cyclicals?

Chart 1: Is it just the AI wave or is manufacturing following suit?

If the manufacturing cycle is indeed improving, Natural Gas is starting to look extremely cheap. Here is the case..

0 Comments