Steno Signals #51 – Bye bye inflation, hello lay-offs? Here is what to trade..

Happy Sunday folks and welcome to our flagship editorial!

Today we will cover the following topics:

1) The US debt ceiling deal and the impact on liquidity

2) Why inflation is coming down and the spill-overs to the labor market

3) Why the growth cycle looks weaker than feared

4) Why China and Turkey are on our investment watch lists

Let’s get right to it.

The US debt ceiling deal and the impact on liquidity

The debt ceiling is now suspended and the US is able to add new debt on a net/net basis! It is too early to call off the risk of a government shutdown as the annual spending bill drama looms in August/September but who cares for now..

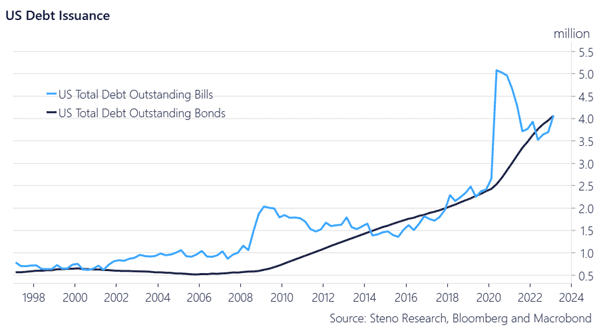

The US Treasury is likely to flood markets with bills in coming weeks and months. When the US Treasury aims to swiftly fill its coffers, bills remain the weapons of choice, which is a conciliatory financing strategy for markets. This happened in 2020 and also in late 2021, when the debt ceiling was lifted/suspended as well.

The US Treasury will only slowly but surely increase the duration profile of the new debt over the coming quarters to massage the effect into markets.

Find out how to trade it with a 14-day FREE trial below.

Chart 1: Bills will be the main weapon of choice

When headline inflation wanes fast, real wages grow, while corporate profits shrink. This is now the base case for H2-2023 while Chinese and Turkish political developments MUST be watched from a macro perspective. Here is why!

0 Comments