Steno Signals #46 – Liquidity is drying up fast! Sell in May and go away?

“Sell in May and go away”

– Every single mediocre sell-side strategist over the past 40 years (including myself)

It is well known to everyone in the industry that equity investing is a winter sport. Average returns are weaker from May until October and the amazingly annoying saying “Sell in May and go away” arose on the back of this pattern. We sadly find reasons to use the saying again this year as macro fundamentals have now started to weaken to an extent where the equity market rally in the West looks exhausted. Liquidity is drying up around the globe except for China. Find out how we intend of reshuffling our books below – remember the first 14 days are FREE.

I by the way also want to remind you that we invite our premium clients for a Q&A session on the 10th of May (you should have received the invite in your inbox).

The great discrepancy between the East and the West

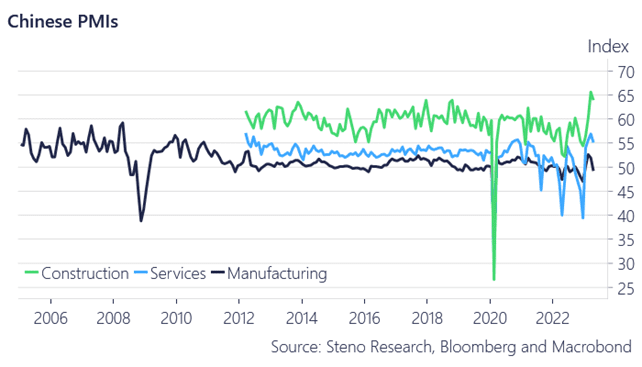

The Chinese Manufacturing PMI printed below 50 (a sign of a recession in the West), while the Service PMI (local consumption) is still VERY solid. The new orders index in the Manufacturing PMI declined to 47.4, which is a clear hint of weakening trends in the months ahead as well. Construction is still REBOUNDING, but from low levels. This is about as much that China can control. Then can unleash the consumer again and they can build – and they are currently firing on both of those cylinders.

Chart 1: A growing discrepancy between services and manufacturing in China

We have been bullish on equities through the year but now see increasing signs warranting a defensive shift in positioning. Liquidity is drying up both in Europe and the US, and BoJ has effectively made further liquidity adding interventions unnecessary. China may be the only place on earth with positive liquidity trends.

0 Comments