Last week (see here), we made the argument that a country caught in a state of fiscal dominance, constantly grappling with the erosion of its domestic currency due to inflation is better off taking a gradual reform approach in talks with relevant partners than throwing the kitchen sink at the existent set-up.

It seems that Javier Milei is opting for a strategy of buying time and seeking favorable terms in New York, a move that hasn’t been met with enthusiasm by some of his new cabinet members- but nonetheless, the one we advised

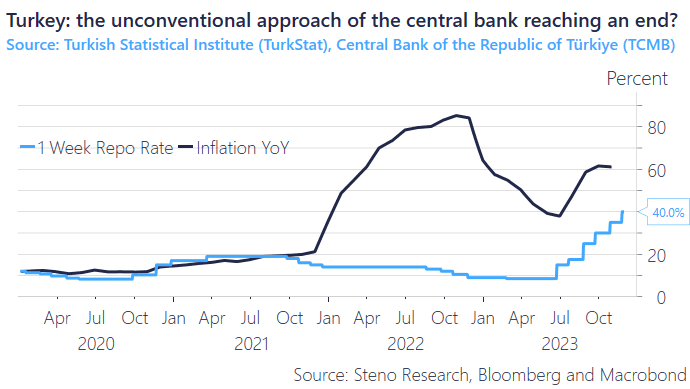

Where do we see such pragmatism at play these days? Erdogan’s Finance Minister, Mehmet Simsek, since he assumed office in June more or less been the poster child for the technocratic pragmatism needed to reform whilst conducting crisis management.

However, it’s important to note that the outcomes thus far haven’t been particularly convincing, even though the newly appointed Central Bank Governor, Gaya Erkan, has been keen to celebrate minor successes with statements like “the time to shift to the Turkish lira has arrived.”

In contrast, Simsek adopts a more cautious communication strategy, recognizing that winning over the favor of the market requires more than just a policy shift. When policy rates remain 20 basis points below the CPI it’s challenging to earn the admiration of investors.

0 Comments