EM by EM #21 Why China is uninvestable yet tough to short

In a recent analysis piece, following the Chinese real estate turmoil primarily led by Country Garden’s crisis (which appears to have been postponed for now, thanks to the recent payment installment), I asserted that the People’s Bank of China was facing a dilemma between bolstering the domestic economy and upholding the Yuan’s fixed exchange rate.

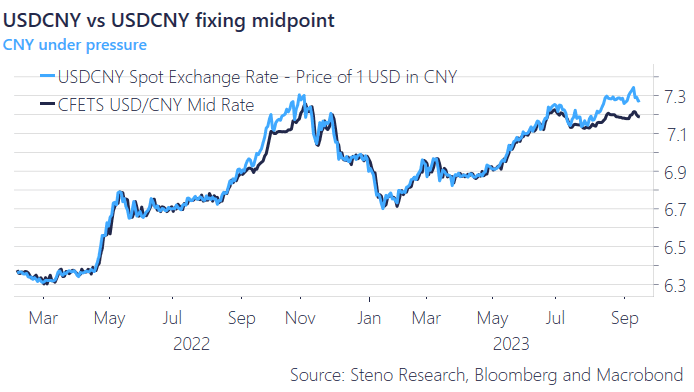

I maintained that, despite the evident necessity for a weaker Renminbi, the PBoC would feel compelled to protect the 7.30 exchange rate, even if it meant compromising internal financial stability and the economic imperative.

Time has largely vindicated this perspective, as can be discerned from the chart below.

Chart 1: USDCNY vs USDCNY fixing

In a recent analysis piece, following the Chinese real estate turmoil primarily led by Country Garden’s crisis (which appears to have been postponed for now, thanks to the recent payment installment), I asserted that the People’s Bank of China was facing a dilemma between bolstering the domestic economy and upholding the Yuan’s fixed exchange rate.

I maintained that, despite the evident necessity for a weaker Renminbi, the PBoC would feel compelled to protect the 7.30 exchange rate, even if it meant compromising internal financial stability and the economic imperative.

Time has largely vindicated this perspective, as can be discerned from the chart below.

Chart 1: USDCNY vs USDCNY fixing

7.30 was the line in the sand but can the Chinese defend their thench? We find it unlikely. But the battleground is not a safe place yet

0 Comments