China Watch: The People’s Bank Pickle – is 7.30 the line in the sand?

Conclusions up-front:

– As the PBoC confronts Yuan depreciation and counters deflationary momentum, the continued divergence between these challenges will strain the central bank’s ability to effectively manage both

– Whatever policy trajectory PBoC chooses there will be uncomfortable trade-offs

– We remain confident that the PBoC will defend the Yuan at the 7.30 level

In light of the ongoing measures taken by Chinese authorities to tackle issues within the real estate sector, the recent rate cuts announcement, along with discouraging concrete data and the persistent depreciation of the Yuan, we find it pertinent to examine the existing state of monetary policy in China:

PBoC is essentially caught between a rock and a hard place if the current headwinds keep mounting. Eventually, they could be forced to pick a side between two objectives:

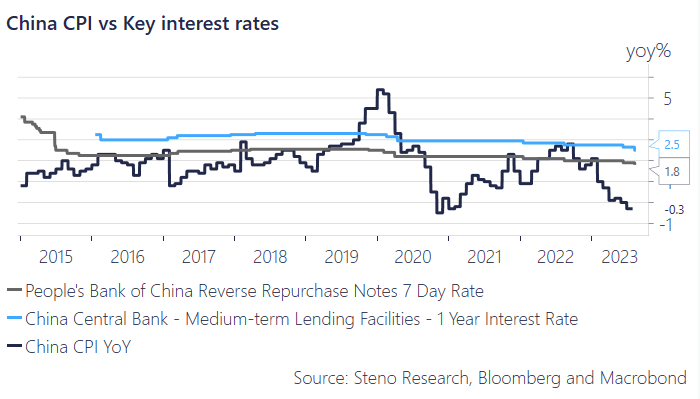

On one hand, China is dealing with a declining nominal demand problem which is reflected in the depressed CPI. That is what last night’s rate cuts are designed to address.

Chart 1: CPI vs Key Interest Rates

(Tomorrow we will dive further into what is driving this behind the curtains, both in a coming research piece and in our Q&A session, see here)

(Tomorrow we will dive further into what is driving this behind the curtains, both in a coming research piece and in our Q&A session, see here)

The PBoC rate cuts are not a surprise to us as the pressures facing China are intensifying. But where does it leave monetary policy going forward?

0 Comments