EM by EM #12 – Is the surging Peso a prelude for a longer Mexico bull case?

The Peso has been the great EM FX darling in this cycle. With sky-high carry and remittances nearing the $60 billion mark last year, it is hardly surprising that the Peso has performed in recent years. But is it a COVID rebound fluke or are we on the doorstep of a new prosperous era for Mexico?

From the ” Tequila crisis” in 1994 to 2019 Mexico managed to double its GDP PPP per capita. That’s less than major DM’s like Germany or their neighbor north of the Rio Grande, The United States, which has delivered a jump from $27K PPP per Capita to an astonishing $65k in the same period.

But even among LATAM peers, it is hardly an impressive record, only beating fellow infant terrible Brazil among major nations. Meanwhile, growth success stories such as Chile managed 2.5x growth and even the tragic case of Argentina has delivered better despite grappling with debt disparities with defaults and ongoing debt restructuring.

Structural outlook and forecasts

But all of this may be about to change. Mexico has all the fundamentals of a success story from natural resources to a productive and relatively cheap labor supply to a favorable geopolitical position.

As with most things in the EM Land, Politics is the key to success- And contrary to many skeptics Mexico is not at all collapsing from the weight of leftist-populist political tenure:

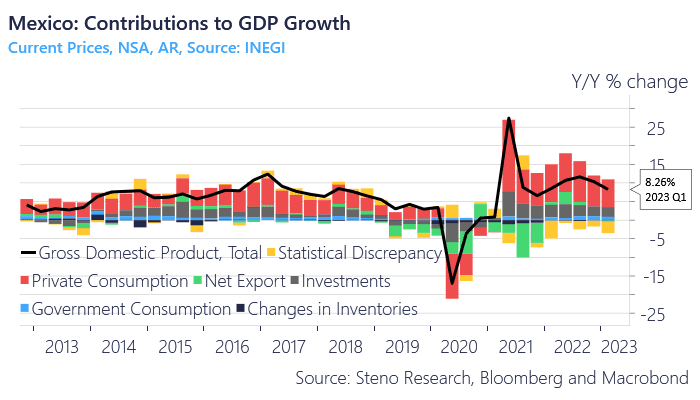

Chart 1: Mexico Growth & Contributions

To access the full piece use the 14-day trial below!

To access the full piece use the 14-day trial below!

Many have profited from MXN carry in the first half of 2023. But is there more left to squeeze out or is it running on fumes? We give our take here and assess the structural patterns at play in Mexico in relation to recent performance and the geopolitical climate.

0 Comments