Something for your Espresso: USDCNY is now the global bellwether (again)

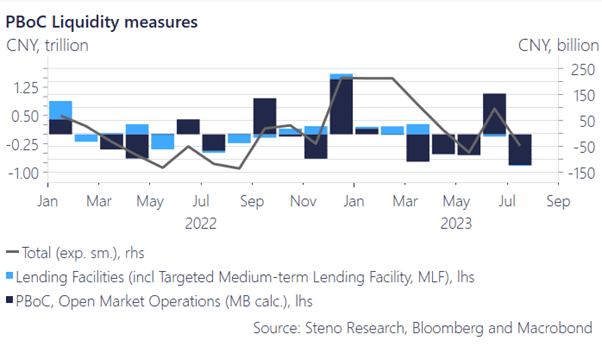

The PBoC is now clearly trying to contain pressures in the CNY via a stronger than expected reference rate and USD/CNH has struggled to keep up momentum currently trading around 7.32. The CFETS fixing mid-point for USDCNY remains below 7.20 and judging from the liquidity measures taken by the PBoC, they are trying to tighten market liquidity to force state banks to underpin the CNY (while cutting rates at the same time…)

If USDCNY breaks meaningfully above 7.30, all hell breaks loose in risk assets and commodities, while a successful defense of the threshold will lead to a relief rally.

We see stronger arguments for a successful defense of the 7.30 level than against due to firm tightness in CNY liquidity.

The PBoC is caught between a rock and a hard place, but the defense of the CNY is probably their main objective at this juncture. More from my colleague Emil Moller on the topic here.

Chart 1: The PBoC tightens liquidity while cutting rates

The panic will subside if the PBoC manages to defend the 7.30 handle in USDCNY. Could we reach “peak China panic” during today’s trading? We look forward to it alongside the FOMC meeting minutes in our morning report.

0 Comments