5 Things We Watch – Natural Gas, ECB, Crypto, Liquidity & Positioning

Hello everyone, and welcome to our ‘5 Things We Watch’, where we as always provide you with 5 things that we find particularly interesting in the world of global macro currently.

This week we are watching out for the following 5 topics within global macro:

1) Natural Gas

Natural Gas has really not been the place to be for a long time, as hotter weather and prudent storage dynamics has left supply WAY greater than demand. As we have advocated for during the last couple of months, the low prices are however not sustainable from a business perspective as no gas companies can sustainably function with prices below pre-covid levels.

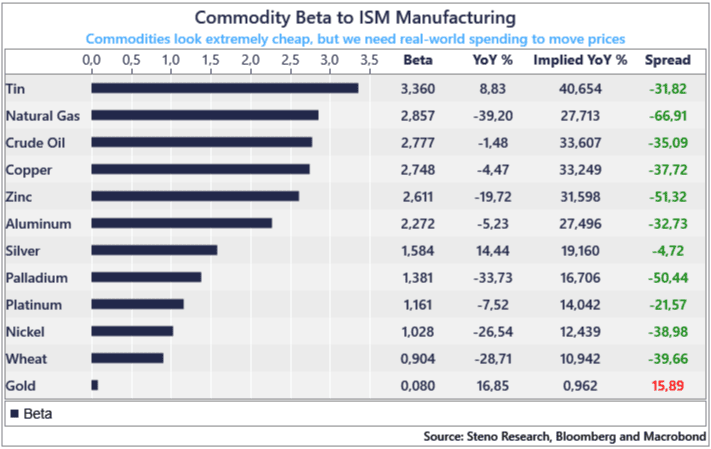

Adding bearish positioning and a manufacturing sector that looks to improve greatly over the next months, Natural Gas is in a prime position for a short-term rally – Natural Gas has the 2nd highest beta to US Manufacturing PMI.

We entered the trade recently with great success, but if manufacturing first starts to get going the trade has a lot more upside to grab. Positioning is already starting to tick upwards, and the trade will get more crowded as price increases.

Chart 1: Commodity beta to ISM manufacturing

Equities have been leading the way in the new year return-wise, but things are starting to indicate that other asset classes might also join the battle. We provide our take here.

0 Comments