ECB Watch: A scope for a decent dovish surprise

The hopes of a March cut are long gone, but the ECB meeting will be interesting to watch nonetheless. The ECB has been dovishly surprised on right about every single measurable parameter since the December meeting, which will likely make its impact at the March meeting.

HICP assumptions for Q1 averaged at 2.9% with the actual prints in January and February coming in at 2.8% and 2.6%, respectively.

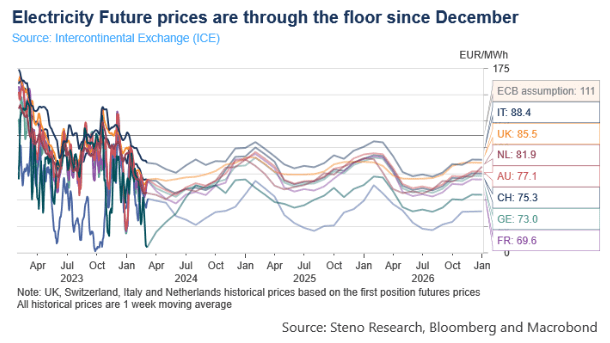

Energy assumptions have been surprised massively on the dovish side with Natural Gas 2025 futures prices trading down from levels around 45 EUR/Mwh to levels below 30 EUR/Mwh. Electricity wholesale future prices are down from averaging around 110 EUR/Mwh for 2025 to levels closer to 75 EUR/Mwh, EU emissions allowances are down from around 82 EURs to less than 60 EURs and Oil prices and the EUR are relatively unchanged in future terms.

In weighted average terms, energy costs are down 25%,20% and 17% respectively in 2024-2026. On a stand-alone basis it speaks for a massive downgrade of the HICP inflation forecast but the ECB hawks will likely point to services/wages as a counterweight.

Chart 1: Electricity futures trade through the floor relative to assumptions

Despite inflation not dropping to the extent our models had suggested, the ECB has still been dovishly surprised relative to its base case. Will the ECB prepare for cuts at the meeting this week?

0 Comments