Positioning Watch – Are the unpopular bets back in town?

ello everyone, and welcome back to our weekly positioning watch!

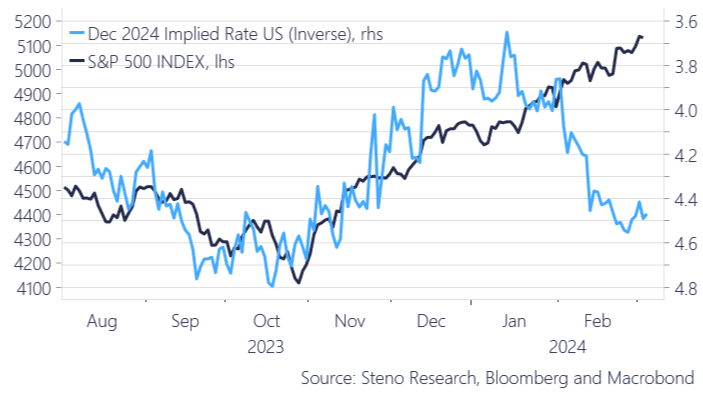

Equity markets continue their drift higher for yet another week, and it seems safe to say that markets are now more concerned about liquidity/growth than rates to reiterate ourselves, as equity markets have not attributed the U-turn in rates expectations any value whatsoever. As the growth and liquidity outlook still looks decent for the weeks/months ahead, we keep our long risk asset bias.

The rates outlook looks to have a bigger impact in FX and especially the carry-heavy side of this asset class, and with the market likely going to up-hawk expectations even further if inflation picks up momentum, it could be time for a revival of the USD – FX volatility has at least started to pick up a bit of momentum (bullish USD).

At the other end of the spectrum, both commodities and fixed income have remained fairly silent over the past weeks, but we are starting to see early signs of a rebound positioning-wise.

Chart 1: Equities doesn’t care about rates anymore

Equities continue to thrive given upbeat liquidity and growth conditions, while Fixed Income and commodities have provided more of a lackluster return, but are the unpopular bets returning in positioning data?

0 Comments