Energy Cable #59: More fuel for energy bulls?

Take aways:

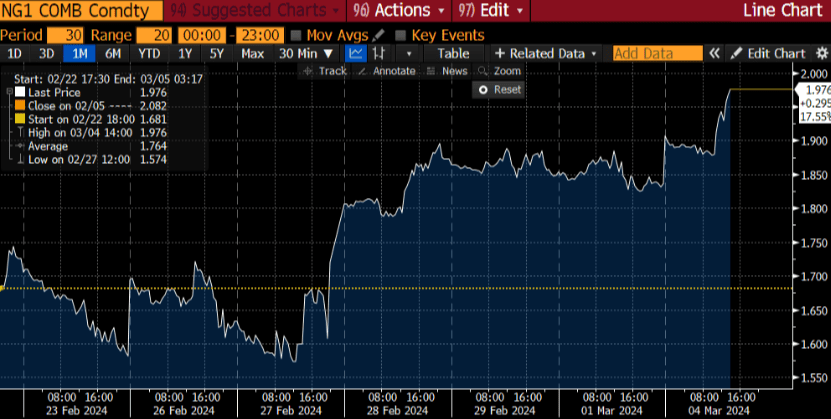

- Another green week for natural gas

- Bullish demand/supply outlook for crude

- Seasonality will now be working in favor of crude

- Israel Hamas-Ceasefire a little less impactful for crude now

Before we get to the OPEC supply cuts and crude, we would like to address our natural gas position from a couple of weeks ago. Our timing has been very fortunate with the position, as the market realized that we were trading too low. As we predicted, the low prices act as a natural constraint on supply as seen most recently by EQT Corp. cutting production due to low prices.

We continue to like the position and note there is room for managed money to start catching onto the trade since positioning data from the CFTC only show net shorts being scaled back a little.

Should shipping activity in the Panama- and Suez canals pick up from current abysmal levels (it cannot get any worse), we also see the regional abundance of Nat Gas in the US fading due to rising exports.

Chart 1: Henry Hub continuing its tear

Focus on OPEC’s continued production cuts into a story of bouncing growth which sets up a tasty story for crude and maybe also natural gas! Read why here!

0 Comments