5 Things We Watch – Freight Rates, Positioning, Liquidity, EUR-flation, Growth

Welcome to the first 2024 edition of our ‘5 Things We Watch’, where we as always try to dissect global macro trends, how we see the world and how we trade it.

The overall consensus this year seems to be locked in on a soft landing in the US, but in our view, risks of tail-end events are increasing, making macro more important than ever in order to navigate financial markets in 2024. Read along, as we run through some of the things that we see as alpha-omega in the coming weeks.

This week we are watching out for the following 5 topics within global macro:

- Freight Rates

- Positioning

- Liquidity

- EUR-flation

- Growth

1) Freight Rates

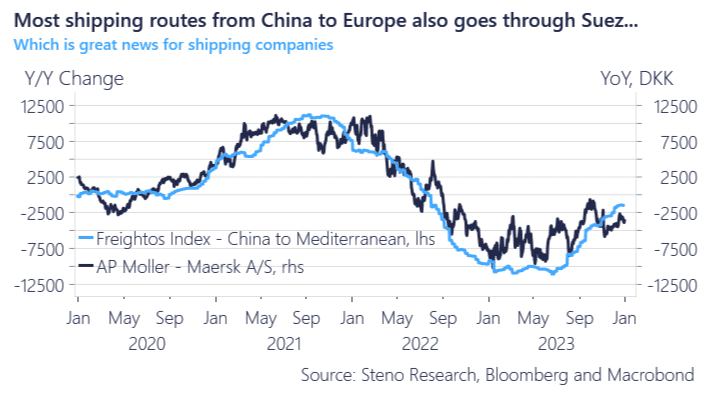

Freight rates on routes with destinations in the Mediterranean (both shipments from Middle East and China) have generally been on the rise ever since the conflict in Gaza / Israel began, and it has more or less been one-way traffic since then, which could be a worrying sign for inflation in coming months if supply chain pressures continue to mount.

Re-routing ships around South-Africa instead of Suez is costly, and because freight rates are normally settled in USD, a weaker USD naturally puts further pressure on freight rates, making us think that the trend will likely continue for some time. So.. who looks to gain from this?

Based on simple beta-studies from the post-pandemic period, the current sweet-spot where geo-political tensions has not made shipping companies avoid the Suez passage completely while being able to require higher prices, classical European shipping companies like Maersk, Star Bulk Carriers etc. looks to gain, while industrial-heavy indices in Europe/Asia like DAX and Nikkei look to weaken.

Chart 1: European shipping companies looks to gain

Limited upside in the ISM Manufacturing index as we await a dovish EUR-flation number coming in on Friday. There are plenty of things to look at in the global macro landscape this week.

0 Comments