5 things we watch: Downgrades, Cyclicals, Oil, JGBs and GDP/GDI

A credit downgrade of the US sovereign debt amidst a steepening of global curves triggered by the Bank of Japan finally making mini-steps towards normalization of monetary policy. Macro never fails to surprise and here is how we view the five most present topics in global macro.

This week we are watching the following 5 topics within global macro:

You can find in depth research pieces on all topics on the links below or just read our brief summary in this article

- The US credit rating downgrade

- Performance in cyclicals to defensives

- An oil breakout?

- The flows in JGBs and JPY

- Rebound or recession? Should we trust GDP or GDI?

Theme 1: The US credit rating downgrade

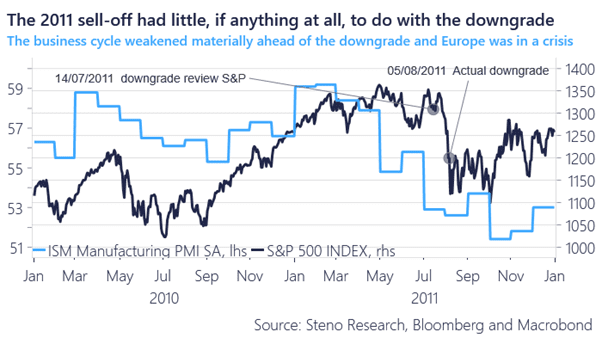

Woop woop. We are suddenly back discussing the credit quality of the US Treasury issuances as Fitch followed in the footsteps of the S&P and downgraded the credit rating more than a decade later.

We see this discussion as one big nothing burger. The US Treasury is without any competition the biggest revenue machine on Earth, while they can issue/print the very mean of payment that they use to pay back debt.

The US credit rating is hence only relevant for international payments and/or as a reflection of the >0% risk that an increasingly bizarre political majority allows the US to default on purpose. The US cannot default unless they want to. If a US Treasury is not AAA, nothing is.

Chart 1: Markets sold off around the 2011 S&P downgrade but recovered in to 2012

The US credit rating downgrade is making the rounds, but is it even relevant? We take a look at the empirical data alongside updates on the five things we watch currently in global macro.

0 Comments