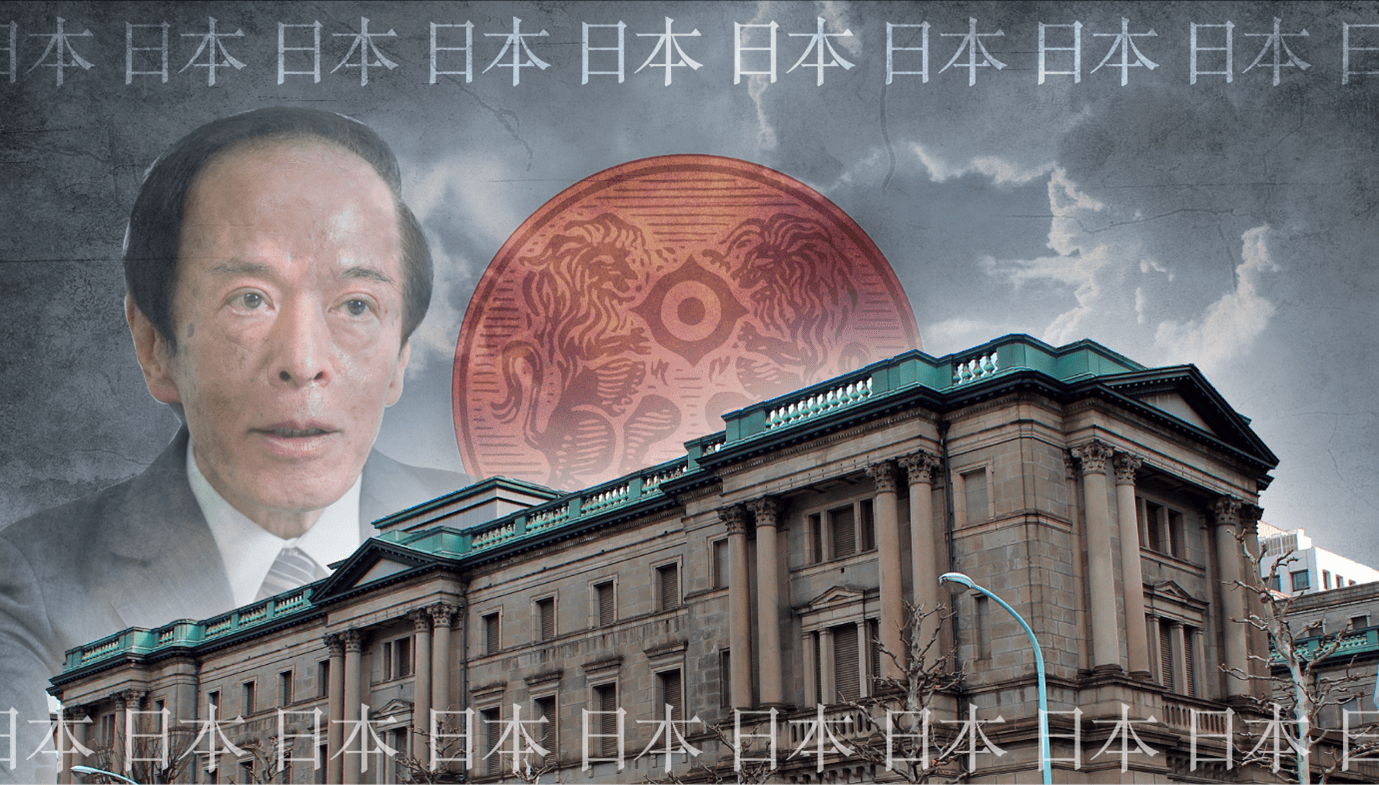

Japan Watch: Flows in JPY and JGBs after the YCC decision

The change to the YCC-policy in Japan caught a majority of investors off guard, but so did the subsequent flows and moves in Japanese markets. We kept reiterating that JGB yield risks were to the upside, while the JPY could see downside, which is exactly what has happened.

In this piece, we will try to elaborate on why that is and why we see a slow grind to 1% in 10yr JGB yields alongside a move in USDJPY to +150 territory.

The BoJ will remain active in JGB markets despite the new YCC-policy-cap and with the flexibility of the new target range, it is hard to judge exactly how much the BoJ will have to print to keep orderly trading intact in the JGB market.

Up until June, the BoJ essentially bought roughly the exact net issuance in the two quarterly peak issuance months and much more than net issuance in the third “redemption month” in JGBs. Net/net they kept increasing market shares as % of total outstanding and they will likely continue to do so despite the new target range for the 10yr JGB yield (see chart 1)

Whether they can get closer to zero purchases in times of less stress in global bond markets remains to be seen, but they will have to keep pressing CTRL+P given current bond market trends as we warned about before they took the decision to alter the YCC-target.

Chart 1: Bank of Japan is, ahem, interventionist to say the least

How on earth can the JPY weaken when 10yr JPY yields are on the rise? We look at flows and investment mandates and how they impact the JPY and JGBs. We still see 150+ on the horizon for USDJPY.

0 Comments