5 Things We Watch: BoJ, JPY & CNY, Monetary trends, UST selloff & Biden’s visit in Israel

Welcome to this week’s edition of our weekly recurring ‘5 Things We Watch’. Which fool said macro was boring? Loads of moves to address but we’ve condensed our scope for you to catch up on the handful we dedicate marked attention:

The 5 things catching our attention this week

- BoJ inflation forecast and presumed policy-change

- Mounting pressure on the CNY (and CNY)

- Monetary trends in USD and EUR

- The continued selloff in US Treasuries

- Biden’s trip to Israel

1) BoJ inflation forecast and presumed policy-change

As all prints through 2023 (April – April) have so far been above 3%, the July forecast of 2.5% remains fairly out of sync with reality, and a central scenario of (at least) 3% should be on the cards. Remember that the BoJ moved the 2023 central projection from 1.8% to 2.5% in July, meaning that another increase of 0.5-0.6%-points will be nothing “out of the ordinary” for them in this most recent inflation cycle.

The decision to increase the inflation forecast again is essentially a no-brainer conclusion given how firm inflation has been relative to forecasts, but the big question is whether it matters for the policy decision? The short answer is yes.

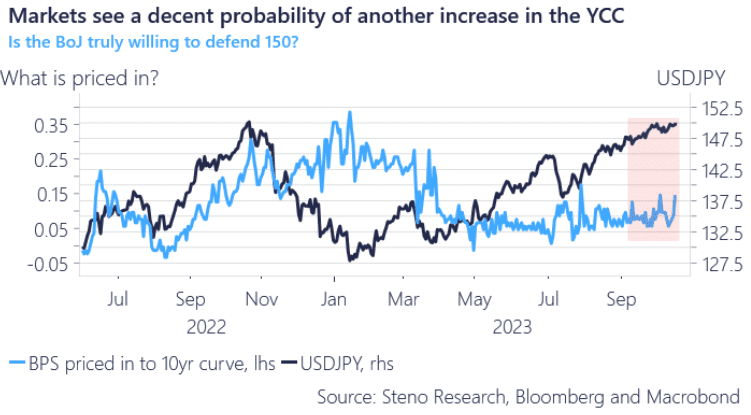

When the BoJ moves the needle a lot (as in July), they also move the needle on policy. Expect another move in the YCC-cap of 25-50 bps with even greater flexibility introduced and expect a weaker JPY again.

A central scenario at or above 2% for both 2023, 2024 and 2025 would also likely be one of the prerequisites for a complete abortion of the YCC, even if the BoJ is still pretty far from daring to take that decision. (Read today’s Japan Watch in full here)

The next Japanese CPI report is out overnight on Friday.

Chart 1: Markets see >10bps priced for the YCC

While tension keeps mounting in the Middle East, we’ve decided to broaden the global macro-horizon. From rising pressures in Japanese policy and the preceding Asian currencies to monetary trends in EUR and USD, and everything in between. We break down this week’s most noteworthy developments.

0 Comments