Japan Watch: Time to care about the BoJ again!

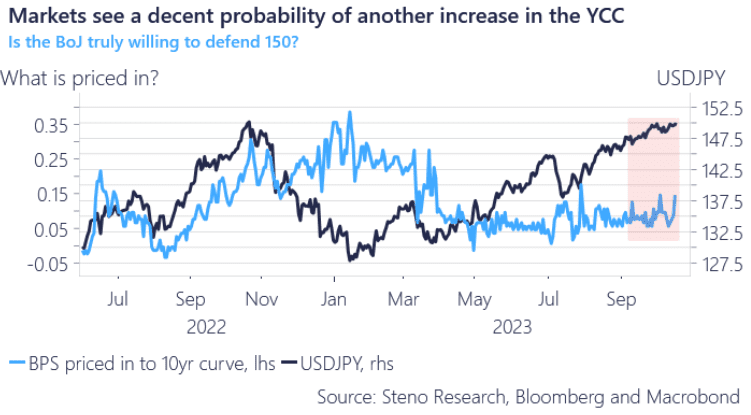

Yesterday, Reuters wrote an article with a few sources hinting at another increase in the inflation forecast profile of the BoJ at the meeting concluding Oct 31. If this was not a deliberate trial balloon to try and push USDJPY lower from the 150 mark (we doubt that), then we ought to take this message seriously.

The decision to increase the inflation forecast again is essentially a no-brainer conclusion given how firm inflation has been relative to forecasts, but the big question is whether it matters for the policy decision? The short answer is yes.

When the BoJ moves the needle a lot (as in July), they also move the needle on policy. Expect another move in the YCC-cap of 25-50 bps with even greater flexibility introduced and expect a weaker JPY again.

Let’s have a look at why…

Chart 1: Markets see >10bps priced for the YCC

The BoJ will have to revise the inflation forecasts UP again later this month ultimately signaling that inflation will be above 2% for the next two years. Global bond markets should start to care about the BoJ again!

0 Comments