5 Things We Watch: Banks, Liquidity, Debt Ceiling, Euro Area Positivity and USD Strength

Wednesday has arrived, and by now you know the drill. Once again we narrow down what’s currently on our radar to the 5 things we monitor the closest. This week’s economic calendar is exceptionally packed, and we’ll of course cover the upcoming FOMC meeting live, posting all things relevant to your portfolio allocation. You can find the liveblog here.

This week we’ll try to unwrap the following 5 pressing questions captivating macro:

- Regional vs. Large Banks

- USD liquidity

- The debt ceiling

- Peak Euro area positivity

- Relative USD strength

Let’s dive right in!

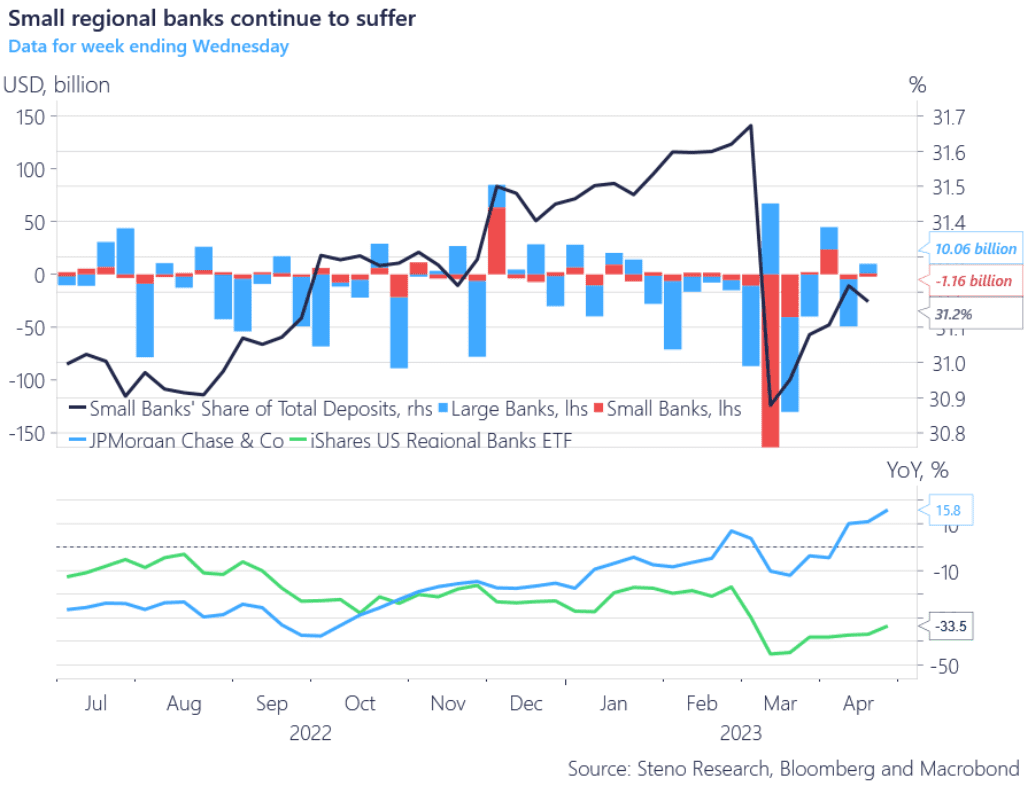

1) Regional banks vs. large banks

As we have emphasized and repeated, the inversion of the yield curve has been the root cause of the liquidity squeeze on small and regional banks. To mitigate the adverse effects of their interest rate policy, the Federal Reserve has implemented several temporary open market operations (WD&BTFP). While these operations aim to address immediate consequences, it is important to acknowledge that they merely postpone the fundamental issues at hand.

We have been vocal since March about the limitations of these measures in effectively tackling the underlying problem which in turn has been reflected in the share spread between large and regionals these past weeks.

Allow us to reiterate; The underlying root cause of the “deposit flight” is the monetary policy. M2 will shrink if rates are hiked and the Fed balance sheet contracts – and M2 and deposits go hand in hand. The lack of credit growth and money creation is hence the true driver of the shrinking depositor base on an aggregate basis.

We just posted a designated ‘Regional Banks Watch’, which we urge you to go and read.

Chart 1: Large banks gaining in the wake of the deposit flight

Midweek has arrived and that calls for a rundown of the five things we watch the closest. As is the custom every Wednesday, we will take you through these most important themes (and charts) in macro and summarize how we interpret them.

0 Comments