Regional Bank Watch: The one on balance sheets, the collateral damage, and the spillovers to USD liquidity

The mayhem in regional banks continues and we will try to summarize our loads of findings over the past weeks in this short primer on 1) Regional banks, 2) the balance sheet compositions and 3) the spillovers to USD liquidity and other asset markets.

The root cause of the crisis is changing

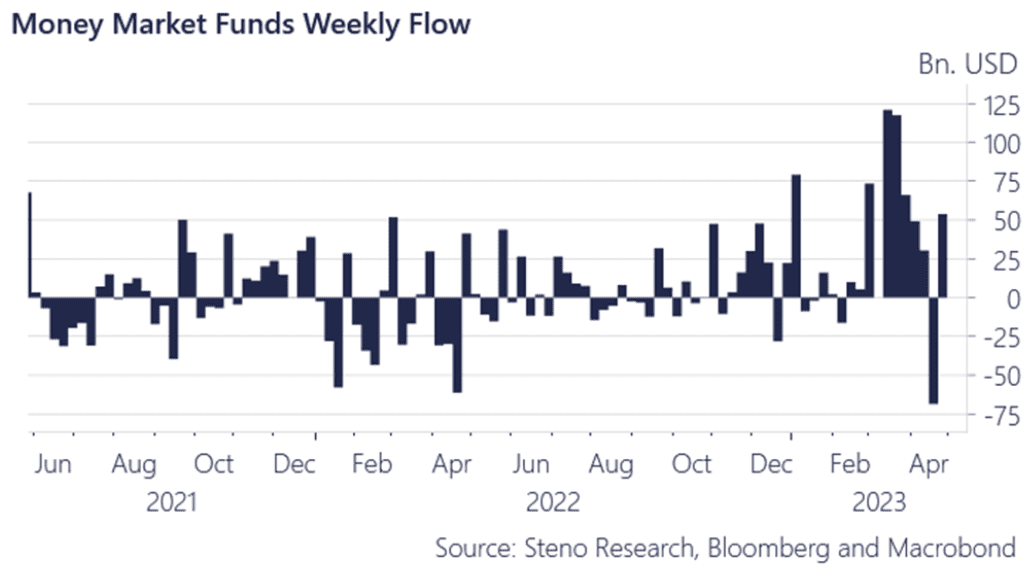

Flows into money market funds have abated from a momentum perspective in recent weeks, likely as the debt ceiling shenanigans cause some concern from a yield- and solidity perspective.

We would like to use the opportunity to reiterate an important point. A flow into money market funds, does not cause an aggregate deposit outflow from banks (unless the TGA is replenished and/or if money market funds park the proceeds at the ON RRP) as the seller of the T-bill bought by the money-market-fund will receive a deposit at a commercial bank, but it may lead to a deposit flow from small to large banks.

Chart 1: Flows into money market funds have abated but remain elevated

Why will the suffering not end among regional banks despite an abating deposit flight? How vulnerable are balance sheets? And why is USD liquidity impacted by the running FDIC intervention in regional banks? Get the answers here.

0 Comments