5 (+1) Central Banks We Watch – Fed, ECB, BoE, Norge’s Bank, BoJ & BCB

It’s central bank week once again, and that of course calls for us to share our thoughts ahead of the biggest meeting over the next week with Powell being the first to take the stage on Wednesday, expecting to hawk up the rhetoric a bit whilst keeping the Fed funds upper band steady at 5.5%.

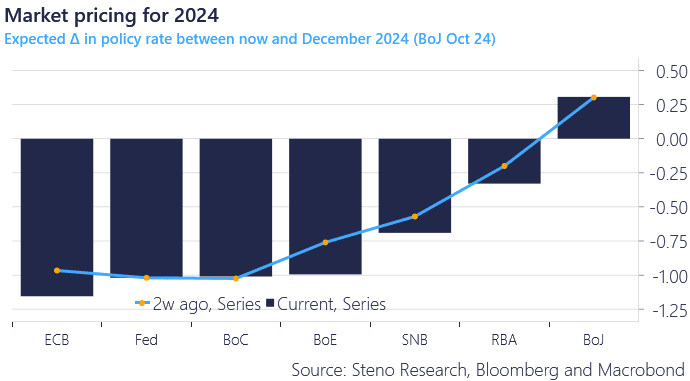

The ECB has recently claimed the title as the most dovish central bank in G10 after markets have added roughly 20 bps of cuts in 2024 to market pricing, and markets now price in approx. 115 bps of cuts in 2024. The ECB, SNB and BoE are the only central banks in our overview that are pricing in more cuts for 2024 now than 2 weeks ago, while the Fed and BoC are now priced to cut rates a tad less than what was priced 2 weeks ago, as forward-looking indicators are pointing towards a resurgence of price pressures.

Interesting shifts in rates pricing dynamics recently, with BoE still expected to cut rates less than the Fed, ECB and BoC despite very soft employment numbers and forward-looking inflation indicators pointing towards inflation normalizing, while BoJ pricing remains status quo – not really any chance of a surprise from Ueda on Monday to be fair.

Our market pricing overview below:

Chart 1: Central bank pricing for 2024

With central banks on duty again this week, we share our thoughts on rate decisions, updated projections and how to play it, before the meetings. Enjoy

0 Comments