US Liquidity & Debt Watch: Yellen to decide the QT tapering timing tomorrow

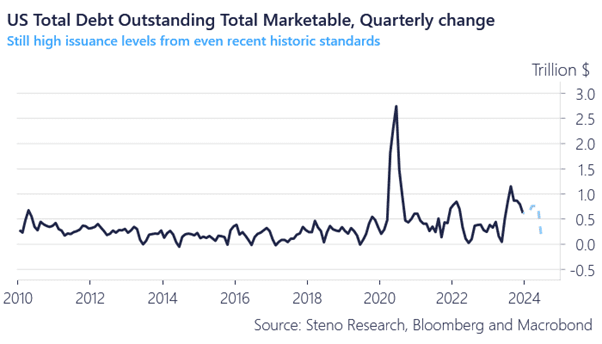

Yesterday, the US Treasury revealed the issuance targets for Q1 and Q2. The net addition to marketable debt is $760 billion for Q1. While this is a substantial amount, it’s $55 billion less than the October estimate for Q1 ($816 billion). In Q2 they expect to add $202 billion, which is on the soft side of Q2 2023.

Chart 1: The new net issuance expectations

Let’s have a look at the details and why this is likely going to impact decision-making from the Fed already at the March meeting.

Yellen holds the keys to an early end to QT. At the surface, she holds all the incentives to get the QT tapering process started sooner rather than later. Will it be reflected in the QRA details tomorrow?

0 Comments