The Energy Cable #37 – The good old fossil fuels are back in business

Happy Monday, and welcome back to the Energy Cable, where we always try to be concise and concrete about what’s going on in the energy space. The last couple of weeks have presented us with what might be a new energy bull run, as markets liked the message from the Saudis amidst a global economy that is in far better shape than feared. So how’s the outlook? Steno Research got you covered on the Natural Gas front, where reigniting energy inflation provides opportunities in the gas space, while 3Fourteen Research takes the oil side, where almost all indicators have been very bullish lately. As an addition, we also briefly touch upon the battle between renewable and nuclear energy in this week’s edition.

Steno Research: Bye-bye base effects. Hello, Greenflation?

Fun fact: In 2009 there were about 35.000 people employed in the nuclear industry in Germany, which at that time produced 135 TWh of electricity. In 2016 there were 160.000 people employed in the German windmill industry which produced a total of 80 TWh of electricity.

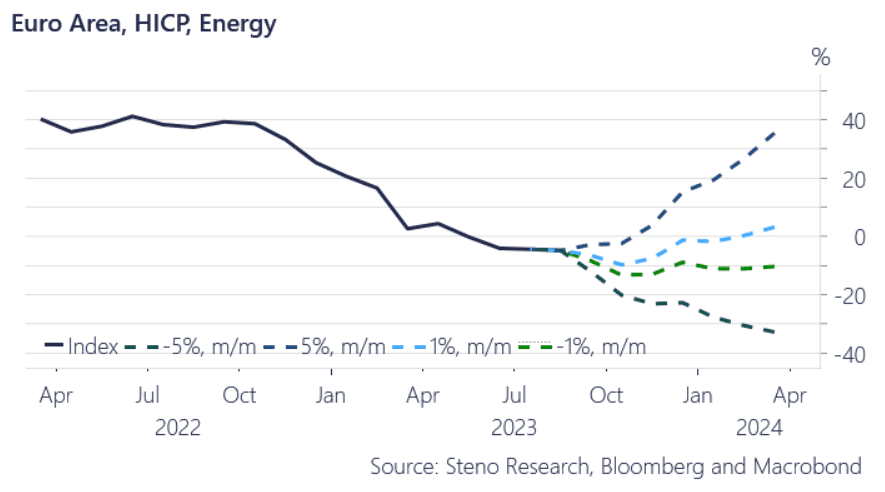

Many signs around the globe point to overall disinflation in many parts of the respective inflation baskets but one part of the basket will face some headwinds, namely energy. We are now moving into base effect territory where the following months will be compared with last fall’s absolute nosedive in global energy prices, especially natural gas. Just look at the below chart where a drop of 1% m/m leaves the European HICP Energy index flat from around October while a 1% increase gives us an increase in inflation y/y by the end of the year.

Chart 1: Even at -1% drop in m/m inflation leaves HICP flat from November onwards

With Brent crude trading above 90$ / barrel, markets beg the question if we are about to enter a new bull run in energy markets – indicators could very well point towards it. But watch out for the elephant in the room: Uranium.

0 Comments