The Energy Cable #29 – A weak USD paving the way for commodities?

Welcome to your weekly maverick energy newsletter from both sides of the pond. Stars are starting to align for energy as i) the business cycle seems to be holding up better than feared, ii) the USD is weakening and iii) ongoing supply negative news (prolonged Saudi Arabian supply cut and Russia abandoning the grain deal).

Time to go long energy? Read below..

Steno Research: Time to turn temporarily upbeat on energy and commodities?

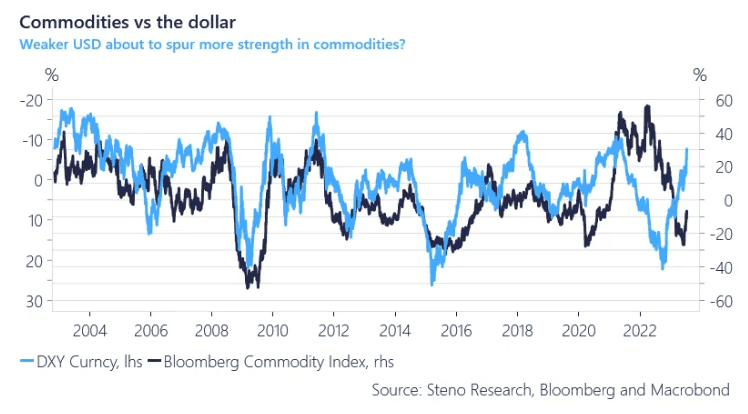

On the back of last week’s dovish US CPI print several FX peers gained against the dollar. As seen below, the Bloomberg Commodity Index has caught up a bit to the weakness in the dollar measured year over year, however we feel that there could be more to come and this along with the reasons we have been listing for the last weeks is cause for more bullishness in crude. In short, the case is pretty clear: A weak USD as a consequence of lower inflation / rates expectations, crude futures in backwardation, Russia finally seeming to cut production.

The sudden weakness in the USD adds to the list of positives for energy and commodities overall. Is the best possible bull setup now in place? We take a look.

0 Comments