The Energy Cable #17 – Testing The Bulls

Welcome to your maverick energy newsletter with updates from both sides of the pond. The oil price has retracted lower despite a string of parameters speaking in favour of higher prices. Will the oil bulls stand the test? We update our price models below, and find clear discrepancies between the oil- and nat gas outlooks.

Enjoy!

Steno Research: Will 2023 bring about a revival of the Nat Gas trade?

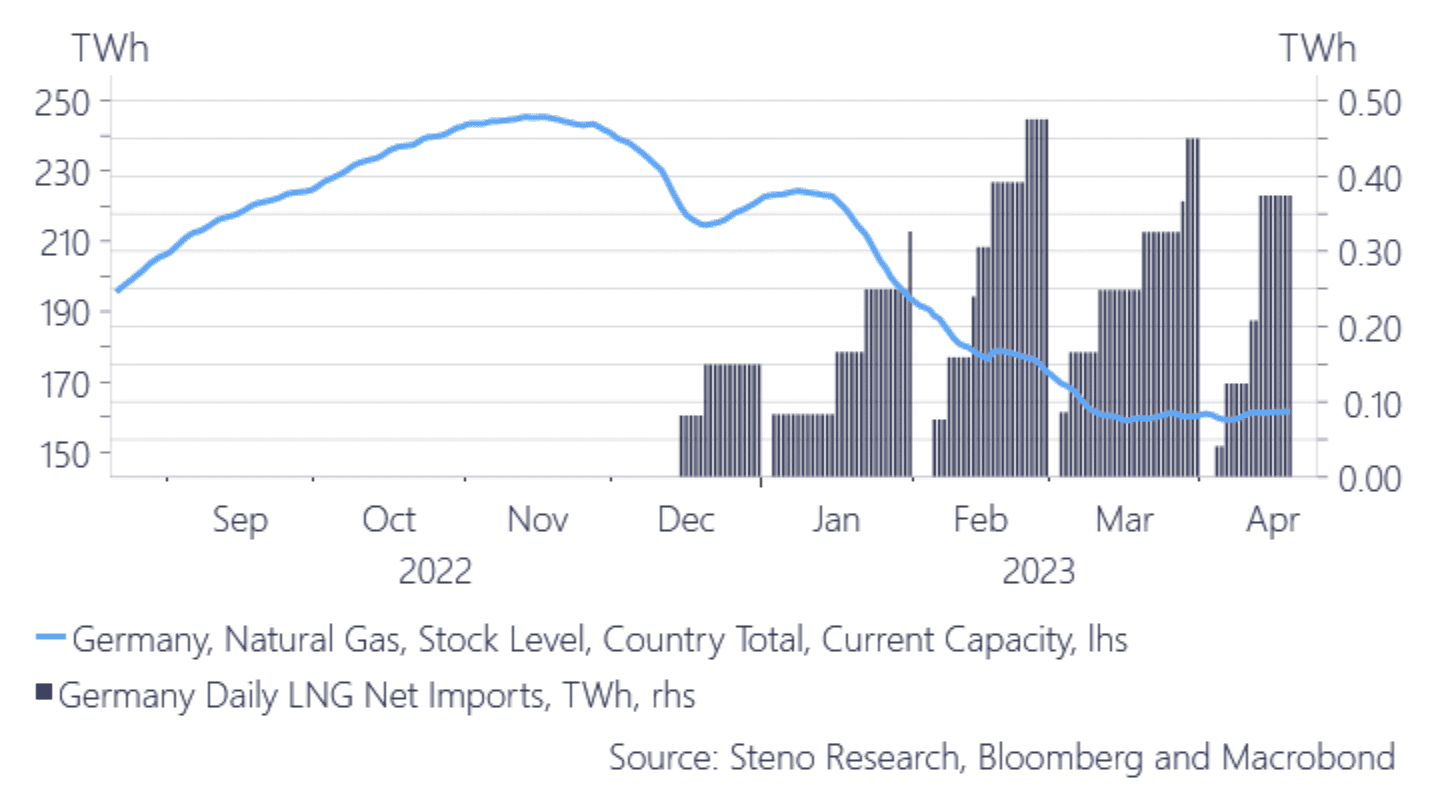

According to this BBG article from this week, Ze Germans are in a wee bit of a hurry to get their LNG terminals ready around new years and this of course made us curious. Turns out Robert Habeck & co are right in their urgency because the current LNG inflow … well, it’s pretty bleak. On a monthly accumulated level Germany had LNG inflow hovering around 0.37-0.47 TWh while the total stock level of both piped gas and LNG was around 190-170 TWh for February till April. In other words, peanuts.

The recent slide in oil prices is interesting given how many fundamentals supported the notion of higher prices. Is this a temporary setback for the oil bulls? And how will Nat Gas fare in this environment?

0 Comments