The Energy Cable #13 – Oil – Bull Case Approaching?

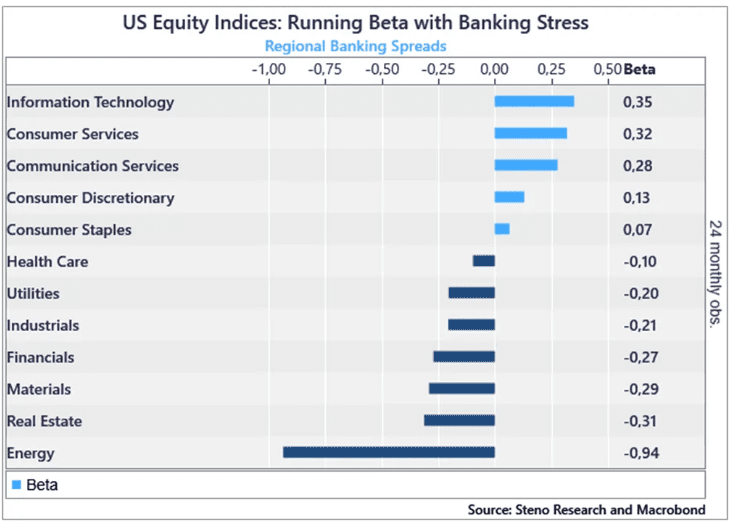

Steno Research: Energy hates banks and banks hate energy

We have been very skeptical about the rebound potential in Energy stocks- and commodities through the year and the banking crisis has recently added to our Energy pessimism. It is hard to find a sector more exposed to an ultimate credit crisis than namely energy as energy intensive sectors thrive from cheap funding, while cyclical activity is almost certain to take a hit, if this turns into a broader confidence crisis in banking.

We certainly lean that way and find reasons to remain worried as the inverted yield curve is the underlying reason for the deposit flight, while the Fed and the ECB is yet to acknowledge that tighter monetary policy leads to a destruction of deposits in banks.

In our empirical studies, we find Energy to be the highest beta to stress in the banking system, which means that Energy stocks drop by almost 1% every time the stress in the banking system increases by 1%.

Energy has been one of the clear victims of the banking stress, but a more positive outlook may re-surface once the dust settles. Is it time to get upbeat on oil prices? Andreas and Warren disagree.

0 Comments