Rates Watch: Are we all still chasing that cutting cycle too early?

In light of the firmer than expected CPI report from the US, we have re-visited our curve views across major currencies.

We find the following to be decent risk/rewards:

- USD-EUR spreads can…

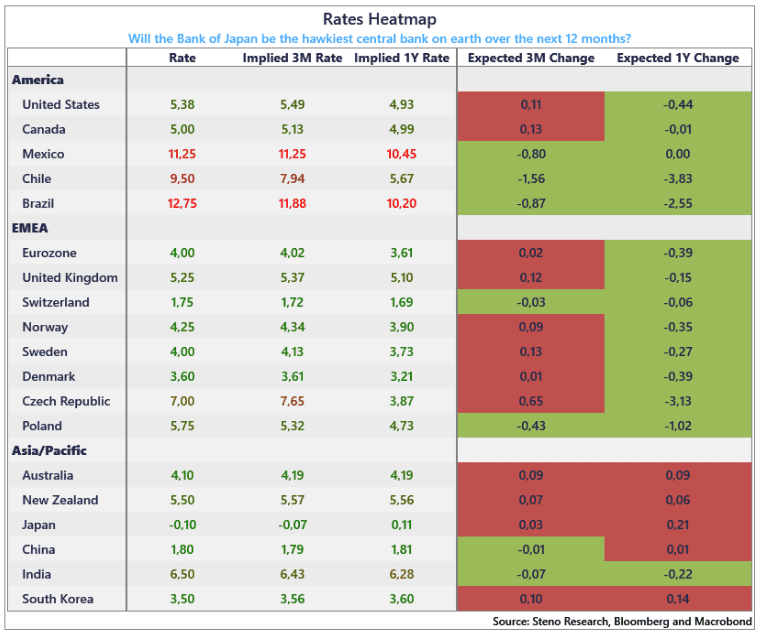

The overview of fwd pricing of the major curves is found below. We do still note that the Fed is priced dovishly relative to the ECB the next 12 months, and we also note that the BoE is priced to remain higher for longer than peers, which we see limited value in pursuing as a narrative.

Let’s go through some of the main reasons why.

Chart 1: Fwd pricing of major curves

Rising manufacturing PMIs, sticky labour markets and re-accelerating services inflation in some categories. Have we all underestimated the risk of the Fed continuing on a path of higher(er) for longer again?

0 Comments