Positioning Watch: The EUR is the only one left at the party

Happy Saturday folks. With the banking crisis back and running, Ueda throwing the JPY to the wolves and the debt ceiling pressures, there are certainly factors that could impact the positioning of traders. Let’s look at how traders are positioned and if you have chosen the same bets (Hint: you probably have to be short). Remember that as always, most of the positioning data presented in this piece can be found on our Datahub right here.

Without further ado, let’s jump straight into it.

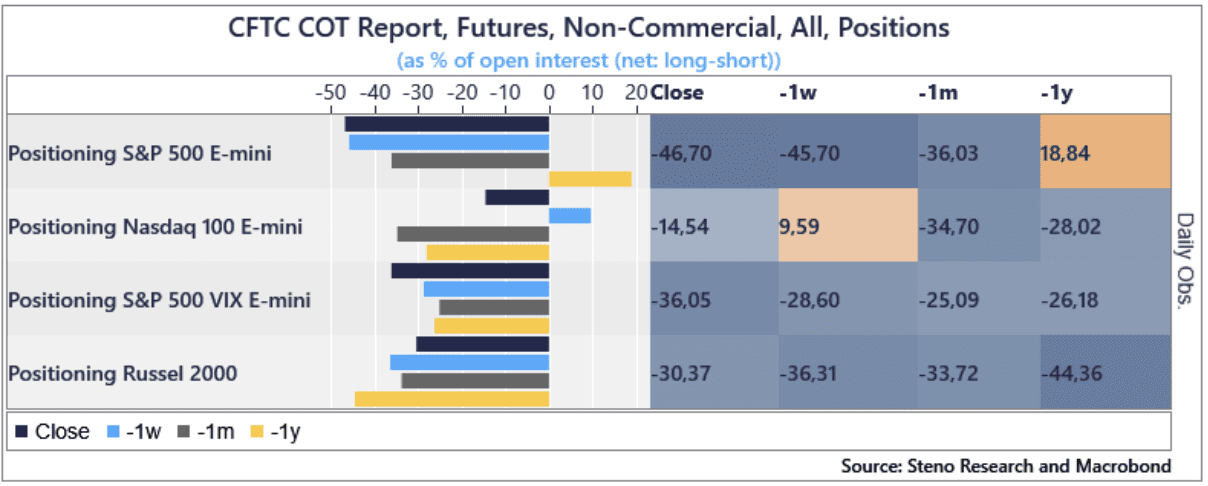

Equity positioning: Nasdaq positioning is (finally) short again

– Nasdaq positioning has flipped in the past week from being long and is now short again The market is feeling the pressure of the banking crisis and the uncertainty about interest rates

– Overall equity positioning remains short but the sentiment is not overly bearish across styles/sectors

Chart 1: Equity positioning

With the failure of First Republic Bank and Ueda’s dovish remarks, we once again dig into how traders are positioned across asset classes. Find out if you have picked the right horses in this week’s edition.

0 Comments