Positioning Watch – Positioning for lower yields and weaker USD

Hello everyone, and welcome back to our weekly positioning watch where we run through interesting observations found in positioning data for the latest week (now back on schedule).

Recent trading days have been all about lower bond yields, a weaker USD and rising equity prices, as risk asset prices are at the moment all about discount rates and swap-pricing of the future of central bank policy. As we have addressed, conditions are slowly but surely starting to decrease the risk/reward of going long-risk assets at current junctures. Still, markets seem to be all about rates, ignoring underlying economic trends.

Read along as we go through positioning data, asset class by asset class.

Equities

- Equity markets have been allowed to continue their rally on the back of bond yields and the dollar continuing to creep lower.

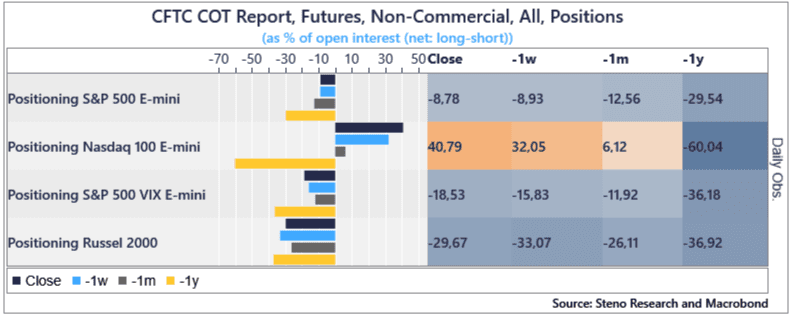

- Tech is still the hot bet towards year-end as the magnificent 7 continue to perform and lift US equities. Despite basis trading pulling net long positioning down, Nasdaq positioning is turning VERY bullish, and technicals are close to indicating that US equities are overbought.

- We still see equities gaining a bit from lower yields / weaker dollar, but the risk/reward is great enough to enter a trade. Risk assets are (finally) risky again.

Chart 1: Indices positioning

Markets have been all about lower yields and a weaker dollar over the past weeks, but positioning data remains pretty upbeat on the greenback.

0 Comments