Positioning Watch – Markets betting on lower rates and higher oil prices

Welcome back to our weekly positioning watch, where we as always provide you with our latest findings on sentiment, positioning, and everything in between.

Let’s have a look at the details.

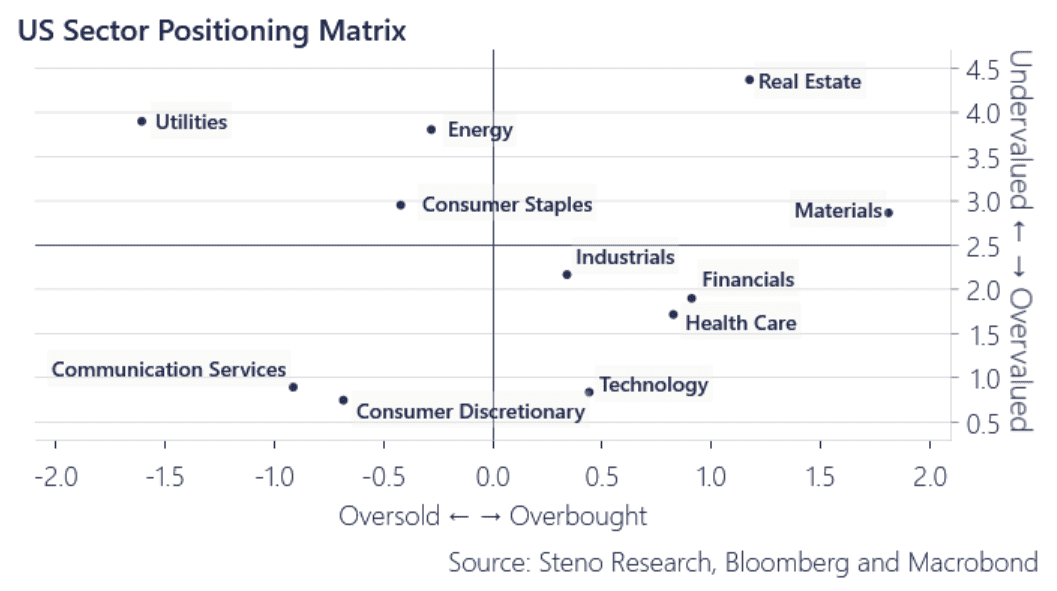

We have updated our positioning matrices for equities, which continue to show support for utilities, energy and staples. While consumer staples lie close to neutral levels on both valuation and positioning, energy still looks decently undervalued, and the current debacles in the Red Sea could grant further tailwinds for energy companies as oil prices have broken out of the 70-75 range where it has been trading for the most of January. Utilities on the other hand still look risky as a trade for now given the solid downtrend, but should momentum pick up again, there is plenty of room for it to rally.

Health and Financials still look both overbought and overvalued, as they have probably been the preferred defensive sectors to mitigate overall portfolio risk towards a slowdown in the US economy, which however by all odds doesn’t look to come anytime soon, and hence Financials have thrived with higher lending margins, and could likely continue higher. Health Care on the other hand looks exposed at current levels around ATH.

Chart 1: US Sector Positioning Matrix

Troubles in the Red Sea have started to drag oil prices and freight rate futures higher with a lag, while rate cut expectations stay firm. Are markets too late on the oil story, or is there more upside to catch?

0 Comments