Positioning Watch: From Japan with Love

Happy Saturday, and welcome back to our weekly positioning article! As always, we are here to take you through the relevant positioning data that we have gathered throughout the week.

This week marked the first brutal decline in markets after a prolonged period of continuous rally, triggered by the BoJ decision. The sudden pullback in UST duration has had a spill-over effect on all markets. However, it raises the question of how this decline has impacted positioning and sentiment among investors?

As always, we’ll dissect handpicked soft data and add some hard data from CFTC on top to give you the best taste of how investors, traders, and we are positioned currently. Remember that you can always find our positions and how we are trading in our portfolio right here.

Without further ado, let’s get straight to our brief overview:

Equity Positioning

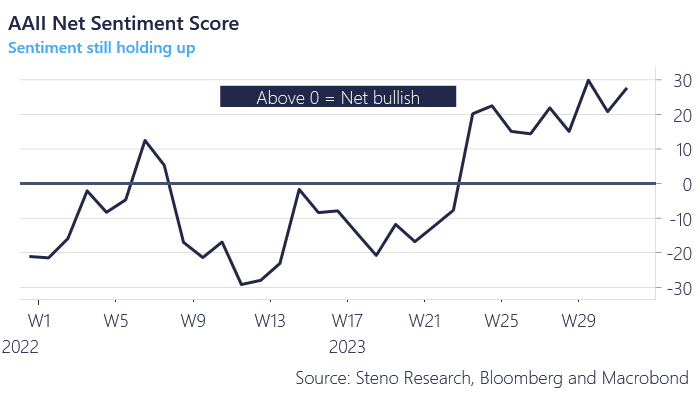

- Equity sentiment remains bullish despite a week of headwinds. AAII’s net sentiment score (Bullish Score – Bearish Score) and CNN’s fear and greed index have been pushed back into “Greed” from “Extreme Greed” for now.

- What remains an open question is whether markets are done adjusting to the new policy framework introduced in Tokyo or what we have seen is merely the “shock”- early days still here a week into the bear aftermath. Perhaps the pace of the UST yield curve steepening will recede and bring some relief to markets

- Weekly ETF flows clearly reflect chips getting removed from the table across equity indices which is hardly surprising given the relentless sell-off.

Chart 1: AAII Net Sentiment Score

A lot of volatility and plenty of aspects to digest after a red week in markets. But how have positioning and sentiment moved? Read here to for our view

0 Comments