Positioning Watch: Does positioning and fund flows unfog the ambiguity ruling markets?

As has been customary, Saturday traditionally means fresh CFTC COT data but, as you may have noticed, the CFTC has run into some data-related issues. Despite releases again seeing the light of day, the data has already passed its expiry date. To counter this time skew we’ll, in addition to the updated positioning dashboards, present to you the predominant fund flows across the respective asset classes. As always, we’ll highlight the peculiarities that catch our eyes and leave you with our take-aways.

Without further ado (or reservations regarding data), let’s dive right in and see what we can deduce!

Equities

CFTC

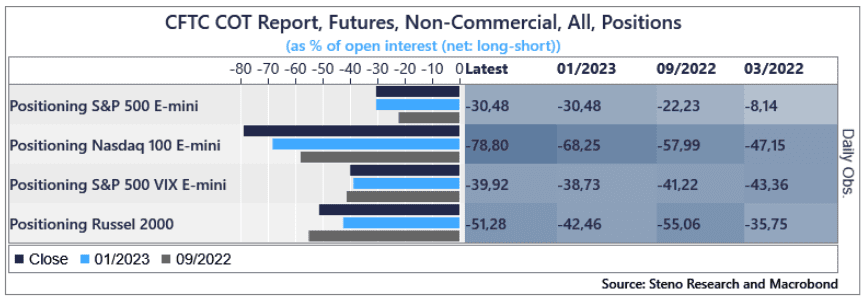

- Investor still have little appetite for long duration, exposing shorts for another squeeze

- Despite the resurgence of high-beta stocks through January/February, the latest available CFTC-data indicates extremely bearish investor sentiment in tech – Tech savagery to the point of overflow

- High beta, high multiples still not in fashion – Russell 2000 not an investor’s favorite still

Table/Chart 1: Latest available positioning (%)

Flows

- Interestingly, Dow topped the scoreboard in terms of …

In this somewhat unusual edition of the ‘Positioning Watch’ we’ll take a look at relevant and readily available data to assess whether we are leaning with or against the wind. Maybe this can provide further insight into the ambiguity which we have experienced in markets lately.

0 Comments