Positioning Watch – Buy everything seems to be consensus

Hello everyone, and welcome back to our weekly positioning watch following the surprisingly dovish FOMC meeting last Wednesday, which smells of a slight policy mistake given what we have been writing about forward-looking price and wage indicators over the past weeks now starting to tick upwards again.

Despite a couple of Fed members trying to retrace after the meeting, pushing back on rate-cut expectations, market positioning has turned VERY bullish over the past week, and oh boy has equity markets positioned themselves for a binary outcome.

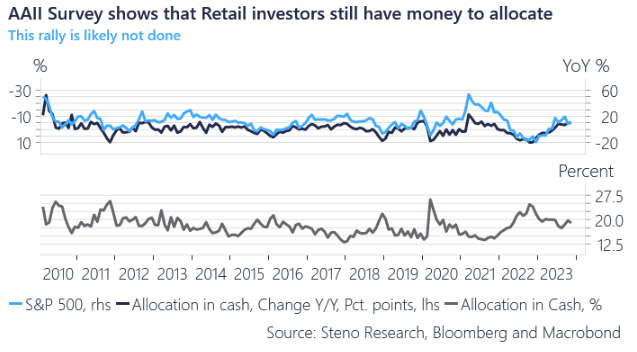

The USDs parked at money-market funds have taken the spotlight since the FOMC meeting, as inflows in MMFs have continued despite 3-month T-bill yields reaching what looks to be a top after Powell’s remarks Wednesday. 150-200 bps worth of cuts would likely lead to a HUGE outflow from MMFs into risk assets, and even retail investors (who likely have driven parts of the rally) have cash left on the sidelines.

There are not many good arguments as to why this rally couldn’t extend for at least a couple of months as liquidity trends are also favoring higher equity prices.

Chart 1: Retail investors still have cash on the sidelines as well

On the back of a Fed meeting markets have been partying like there is no tomorrow. We assess the recent moves in positioning and reflect on how we see markets move leading into 2024

0 Comments